WTI Crude - Waiting for Retracement Confirmation

rhboskres

Publish date: Thu, 22 Oct 2020, 04:41 PM

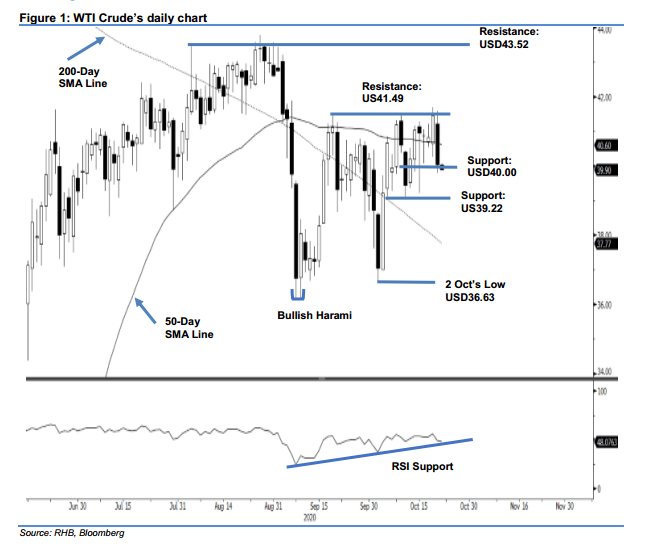

Maintain long positions. The WTI Crude settled USD1.43 weaker at USD40.03 during the latest session after fulfilling our minimum expectations of testing the USD41.49 resistance point during the previous session. The weak closing also placed the commodity back below the 50-day SMA line. Towards the downside, should the USD40.00 support level be breached at the closing of the coming sessions, this would likely confirm the multi-week countertrend rebound – which started from 9 Sep’s “Bullish Harami” – has ended, paving the path for a correction phase to kick in. For now, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD39.22, or the closing level of 5 Oct. To manage risks, a stop-loss can be placed below the USD40.00 mark.

Immediate support is eyed at the USD40.00 round figure, followed by the USD39.22 mark. On the upside, the immediate resistance is revised to USD41.00, followed by 18 Sep’s high of USD41.49.

Source: RHB Securities Research - 22 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024