WTI Crude- Possible Price Rejection Signal Appears

rhboskres

Publish date: Mon, 26 Oct 2020, 10:45 AM

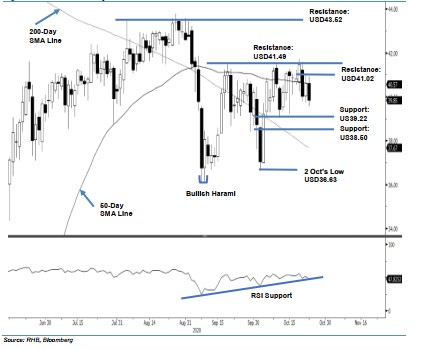

Initiate short positions. The WTI Crude ceased the latest session USD0.79 lower at USD39.85, thus falling below the USD40.00 support level and the 50-day SMA line. The commodity has been showing early signs of developing a correction phase over the past three sessions, after it met our minimum expectation of retesting the USD41.29 resistance point on 20 Oct. We believe the latest weak performance signals that the commodity’s multi-week counter-trend rebound, which started from 9 Sep’s “Bullish Harami” formation, has completed. This implies the commodity’s next move is tilted towards the downside. This negative bias will be enhanced, should the RSI support line be breached in the coming sessions. Switch our trading bias from positive to negative.

Our previous long positions, initiated at USD39.22, or the closing level of 5 Oct, were closed out at USD40.00 in the latest session. Concurrently, we initiate short positions. To manage risks, a stop-loss can be placed above USD41.49.

The immediate support is revised to USD39.22, or the low of 15 Oct, followed by USD38.50. Conversely, the immediate resistance is now set at USD41.02, which was the high of 22 Oct, followed by 18 Sep’s high of USD41.49.

Source: RHB Securities Research - 26 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024