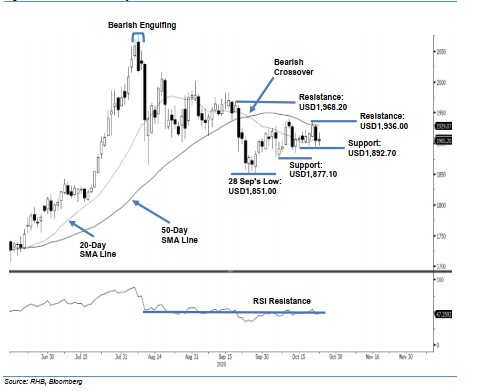

COMEX Gold- Indecisive Near 20-Day SMA Line

rhboskres

Publish date: Mon, 26 Oct 2020, 10:48 AM

Maintain long positions. The COMEX Gold saw an indecisive session, closing flat at USD1,905.20. The precious metal started the session at USD1,927.40. The day’s high or upper shadow was recorded at USD1,917.30, while the day’s low or lower shadow was at USD1,895.20. Overall, the session closed with a doji pattern, indicating that the bull and bear strengths were neutral. Since the RSI fell below the 50% threshold, we expect the precious metal to move in a tight range again for consolidation. The trading range will be between the immediate support level of USD1,892.70, and resistance level of USD1,936. As the technical lows are rising, we are keeping our positive trading bias.

We recommend traders stick to long positions. We initiated these at USD1,903.20, or the closing level of 29 Sep. For risk-management purposes, a stop-loss is placed at USD1,892.70, which was the low of 15 Oct.

The immediate support is unchanged at USD1,892.70, followed by USD1,877.10, which was 7 Oct’s low. On the upside, the next resistance point is marked at USD1,936.00, followed by USD1,968.20, or the high of 18 Sep

Source: RHB Securities Research - 26 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024