COMEX Gold- Moving Sideways in a Tight Range

rhboskres

Publish date: Tue, 27 Oct 2020, 10:32 AM

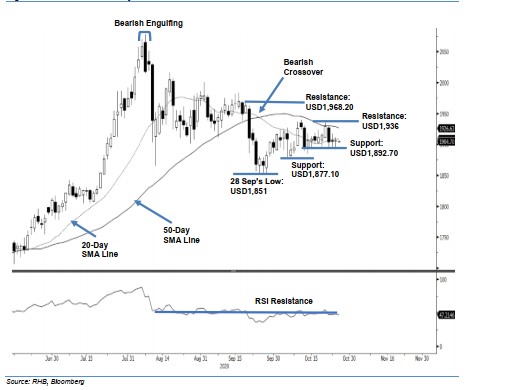

Maintain long positions. The COMEX Gold saw a muted session again, with the bulls and bears both neutral. The precious metal started the session at USD1,906 but closed flat at USD1,905.70. The day’s high was recorded at USD1,911.10 while the day’s low was at USD1,892.50. Overall, the session moved in a tighter USD18.60 range, which was the difference between the day’s high and low. With the RSI recording at the 47% level, we expect the COMEX Gold to be less volatile and trade in a tight range. Although the precious metal managed to stay above USD1,900 mark, the bulls have to stay cautious, as the latest price closed below the 20-day SMA line. A break below the support level may see the sellers surge. While the support levels remain intact, we are keeping our positive trading bias.

We recommend traders maintain long positions. We initiated these at USD1,903.20, or the closing level of 29 Sep. For risk-management purposes, a stop-loss is placed at USD1,892.70, which was the low of 15 Oct.

The immediate support stays unchanged at USD1,892.70 and followed by USD1,877.10, which was 7 Oct’s low. On the upside, the resistance point is marked at USD1,936 and followed by USD1,968.20, or the high of 18 Sep

Source: RHB Securities Research - 27 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024