WTI Crude- on Path for Retracement Extension

rhboskres

Publish date: Tue, 27 Oct 2020, 10:50 AM

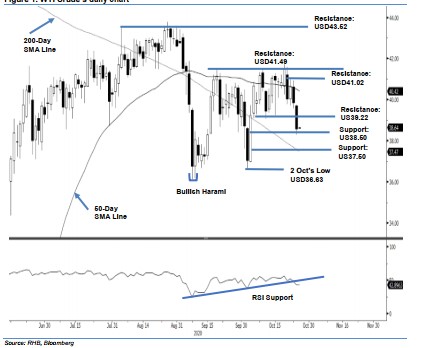

Maintain short positions. The WTI Crude showed a negative price follow-through yesterday after breaking below the 50-day SMA line during the prior session. The commodity generally trended lower for most of the session with the low and high posted at USD38.28 and USD39.74 – it closed USD1.29 weaker at USD38.56. Broadly, we believe the multi-month correction phase that started from end August has resumed. This was after the WTI Crude completed its multi-week counter-trend rebound – which started from 9 Sep’s “Bullish Harami” formation – with the re-testing of the USD41.49 resistance point on 20 Oct. Towards the downside, our minimum expectation is for the commodity to retest the abovementioned “Bullish Harami”. We maintain our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD39.85, or the closing level of 23 Oct. To manage risks, a stop-loss can be placed above the USD41.49 level.

The immediate support is revised to USD38.50 and followed by USD37.50 – near the 200-day SMA line. On the upside, the immediate resistance is now eyed at USD39.22 and followed by USD41.02, which was the high of 22 Oc

Source: RHB Securities Research - 27 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024