WTI Crude- Risk Still Tilting Towards the Downside

rhboskres

Publish date: Wed, 28 Oct 2020, 06:32 PM

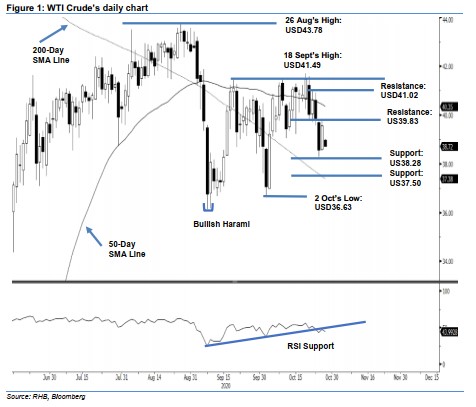

Maintain short positions. The WTI Crude performed positively during its latest session, gaining USD1.01 to close at USD39.57 – this allowed it to cross above the previous USD39.22 immediate resistance. However, based on the daily chart, this encouraging performance is still unable to mark an end to the commodity’s retracement phase, which resumed after the WTI Crude tested the USD41.49 mark on 20 Oct. From the price pattern’s point of view, chances are still high that the ongoing multi-month correction phase, which started from the USD43.78 high on 26 Aug, remains incomplete. We continue to eye prices sliding towards 9 Sep’s “Bullish Harami” low of USD36.13 and maintain our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD39.85, or the closing level of 23 Oct. To manage risks, a stop-loss can be placed above the USD41.49 level.

The immediate support is revised to USD38.28 – 26 Oct’s low – and followed by USD37.50, which was near the 200-day SMA line. Conversely, the immediate resistance is revised to the latest USD39.83 high and followed by USD41.02, ie the high of 22 Oct.

Source: RHB Securities Research - 28 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024