FKLI- Still No Trend Reversal Signal

rhboskres

Publish date: Wed, 28 Oct 2020, 06:34 PM

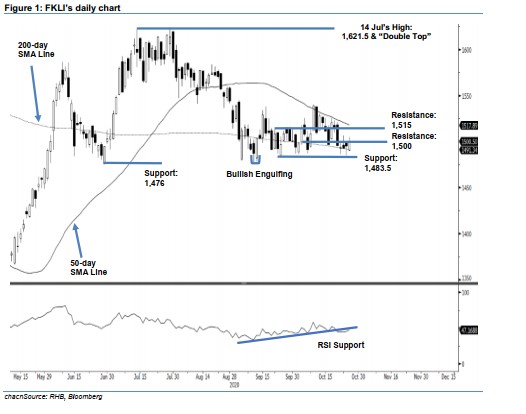

Maintain short positons. The FKLI settled 5.5 pts higher at 1,500.5 pts to marginally cross the 1,500-pt resistance – this comes after it rebounded from a low of 1,489.5 pts. While the index is now marginally located above the 200-day SMA line, we still see this as just part of a minor sideways trading range that has been developing over the latest four sessions around the abovementioend SMA line. Based on the daily chart, we have yet to spot conclusive price signals that indicate a trend reversal is developing. We still believe the index’s retracement phase, which resumed following its failed attempt to cross above the 50-day SMA line early this month, remains incomplete.

We recommend that traders retain their short positons. We initiated these at 1,510 pts, the closing level of 12 Oct. To manage risks, a stop-loss can now be placed above 1,530 pts.

We are keeping the immediate support at 1,483.5 pts, the low of 24 Sep. This is followed by 1,476 pts – the low of 29 Jun. Conversely, the immediate resistance is still pegged at 1,500 pts as it was not decisively breached in the latest session, followed by 1,515 pts.

Source: RHB Securities Research - 28 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024