WTI Crude - Bears Invalidate Bullish Harami

rhboskres

Publish date: Fri, 30 Oct 2020, 06:26 PM

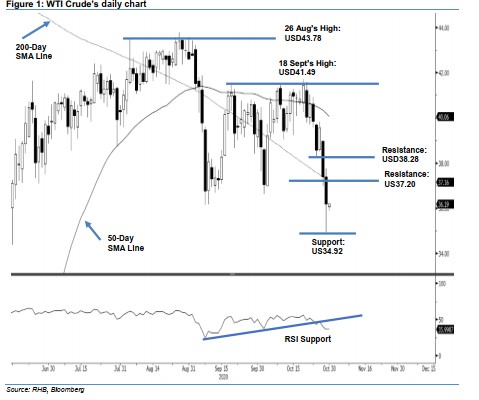

Maintain short positions while moving down trailling-stop. The WTI Crude experienced a second consecutive washout session, ending USD1.22 lower at USD36.17, after managing to rebound from an intraday low of USD34.92. The closing level placed the black gold below the 200-day SMA line, and has met our minimum expectations of retesting 9 Sep’s “Bullish Harami” formation, which is no longer valid. Despite meeting our retracement target and the encouraging intraday rebound off the session’s low, we do not see evidence of an end to the retracement leg. This is further supported by the RSI, which is sliding lower but is yet to reach the oversold mark. Maintain our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD39.85, or the closing level of 23 Oct. To manage risks, a stop-loss can be placed at above USD38.28.

The immediate support is revised to USD35.50 and USD34.92 – both derived from the latest candle. Towards the upside, immediate resistance is set at USD37.20 – near the 200-day SMA line, followed by USD38.28, or the low of 26 Oct.

Source: RHB Securities Research - 30 October 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024