Hang Seng Index Futures- Pounded Below the SMA Lines

rhboskres

Publish date: Mon, 02 Nov 2020, 03:12 PM

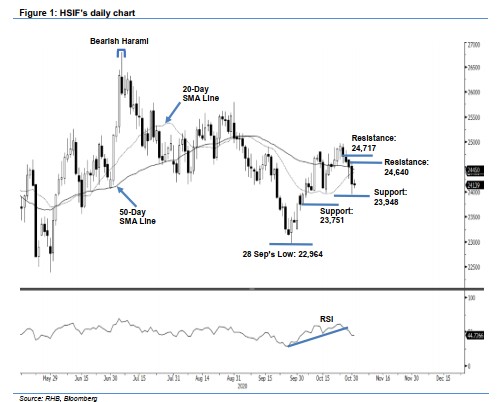

Initiate short positions, as support levels are breached. The HSIF saw a heavy sell-down during Friday’s session, breaching the support levels to trade at a lower low. It started the session at 24,512 pts, briefly trading at the 24,591- pt session high, before plunging 643 pts to a 23,948-pt session low. Towards the end of the trading session, the HSIF managed to recoup some losses, settling at 24,157 pts. As we pre-warned earlier, the index needs to stay above both the 20- and 50-day SMA lines to maintain a bullish structure, but said moving averages are now breached. With the 50-day SMA line pointing downwards, we are expecting more selling pressure on the HSIF. The bears will be aggravated if the 20-day SMA line starts to curve downwards. As such, we switch our trading bias to negative from positive.

Our previous long positions were initiated at 23,951 pts, with 6 Oct’s closing level closed out at 24,466 pts during 30 Oct’s session. Concurrently, we initiate short positions at 24,157 pts. For risk-management purposes, the stop-loss is set at 24,717 pts.

The immediate support is sighted at 23,948 pts and followed by the 23,751-pt mark, ie 6 Oct’s low. On the upside, the immediate resistance is pegged at the high of 29 Oct – 24,640 pts – followed by 24,717 pts

Source: RHB Securities Research - 2 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024