E-Mini Dow- 200-Day SMA Line Holding Up

rhboskres

Publish date: Mon, 02 Nov 2020, 03:13 PM

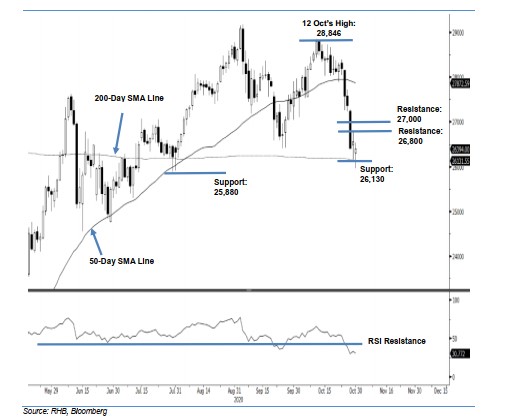

Maintain short positions while moving down the trailing-stop. The E-Mini Down briefly went below the 200- day SMA line last Friday, reaching a low of 25,953 pts before rebounding to narrow losses to 163 pts at the 26,394 pts close. The index has been showing signs of slowing down its retracement over the past two sessions around the abovementioned SMA line. However, it is still insufficient to signal that a positive trend reversal is imminent – at least until further positive price actions are observed. Towards the downside, said SMA line is now acting as a support that, if broken decisively, could open the door for a deeper retracement to take place. Hence, we are keeping our negative trading bias.

We recommend traders stay in short positions. We initiated these at 28,100 pts, which was the closing level of 19 Oct. To manage risks, a stop-loss can be placed above the 27,000-pt mark.

The immediate support is revised to 26,130 pts – near the 200-day SMA line – and followed by 25,880 pts, which was near the low of 30 Jun. On the upside, the immediate resistance is set at 26,800 pts and followed by the 27,000- pt round figure

Source: RHB Securities Research - 2 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024