WTI Crude - Crossing Above the 50-Day SMA Line

rhboskres

Publish date: Wed, 04 Nov 2020, 08:52 AM

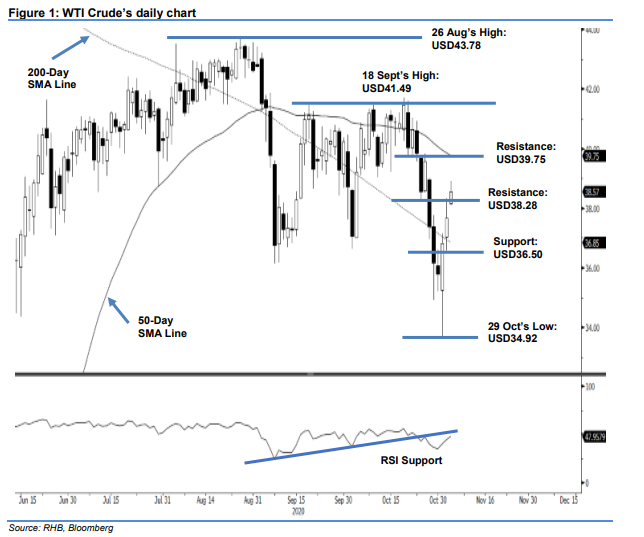

Maintain short positions until the USD38.28 mark is crossed at the close. The WTI Crude continued to extend its recent gains, advancing USD0.85 to close at USD37.66 and crossing above the 50-day SMA line. The rebound off 29 Oct’s USD34.92 low has been relatively strong, and the RSI is also picking up. However, at this juncture, we still believe a closing above the USD38.38 resistance is required to confirm that the correction phase, which started from the USD43.78 high recorded on 26 Aug, has indeed been completed. As of the time of writing, the WTI Crude was trading at USD38.57. For now, we are keeping to our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD39.85, or the closing level of 23 Oct. To manage risks, a stop-loss can be placed at above the USD38.28 mark.

The support level is revised to USD37.50 and followed by USD36.50. On the upside, the immediate resistance is revised to USD38.28 and followed by USD39.75, ie near the 200-day SMA line.

Source: RHB Securities Research - 4 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024