WTI Crude - Bulls Attempting to Reverse Trend

rhboskres

Publish date: Tue, 17 Nov 2020, 11:58 AM

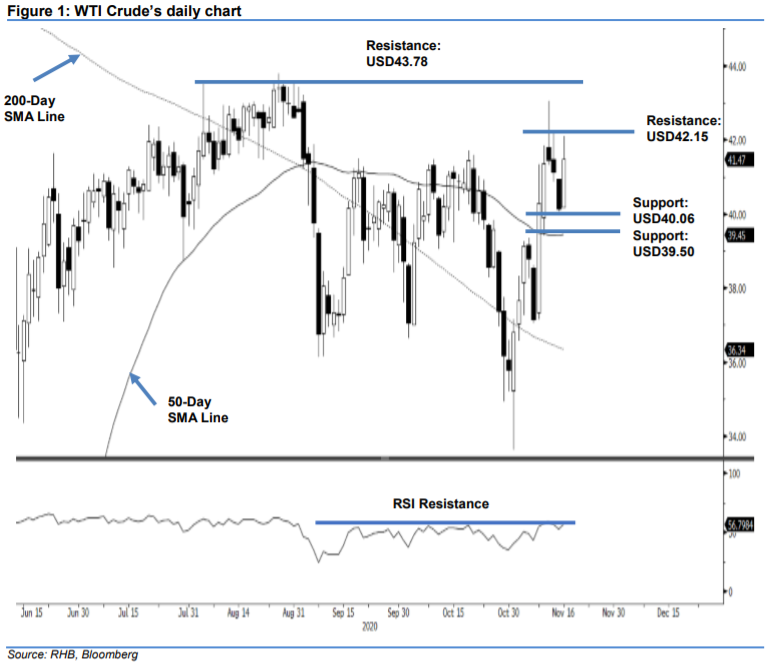

Maintain short positions. The WTI Crude reversed sharply from a low of USD40.15 to reach a high of USD42.09 – before closing USD1.34 higher at USD41.47. The strong rebound came after the commodity experienced retracement over the previous two sessions, following the high of USD43.06 recorded on 11 Nov. At this juncture, we are not seeing the latest positive performance as sufficiently strong price evidence that the commodity’s correction phase has reached an end. Towards the downside, we are still expecting the 200-day SMA line to be tested, at the minimum. Maintain our negative trading bias.

We recommend traders to stay in short positions. We initiated these at USD40.13, the closing level of 13 Nov. To manage risks, a stop-loss can be placed above the USD43.78 threshold.

Support levels are now expected at USD40.06 – the low of 13 Nov. This is followed by USD39.50, which is near the 50-day SMA line. On the upside, the overhead resistance is set at USD42.15, followed by USD43.78 – the high of 26 Aug.

Source: RHB Securities Research - 17 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024