FCPO - Correction Is Underway

rhboskres

Publish date: Mon, 23 Nov 2020, 05:55 PM

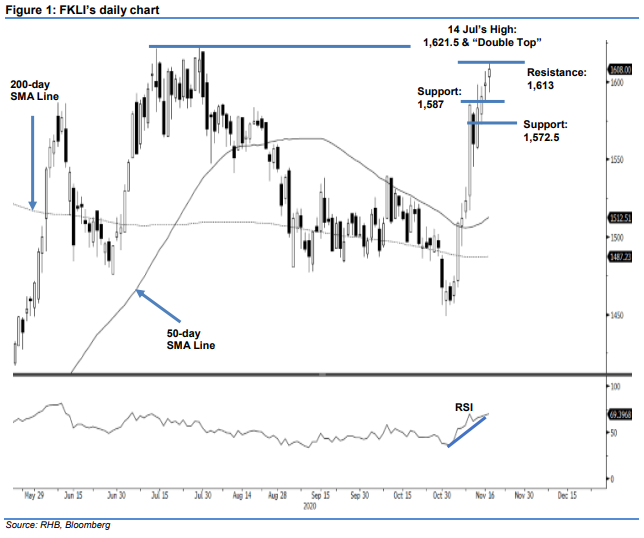

Maintain short positions. The FCPO saw the bears dominating the session on Tuesday. Despite a strong opening, it gapped north by MYR47.00 at MYR3,330 – but the bullish sentiment was short-lived. Not long after the positive opening, the bears seized the opportunity to sell near the session’s high of MYR3,349. Selling pressure prevailed for the rest of the session, and the commodity retraced from the session’s high to the day’s low of MYR3,276, before closing at MYR3,278. With the RSI indicator pointing downwards, we believe the commodity will undergo a further downside correction in the near term. Another possible scenario is that the FCPO may move sideways until the RSI indicator ticks up again. In order for the uptrend to be resumed, the commodity needs to breach and close above the immediate resistance level. Until this happens, we will stick to a negative trading bias.

We recommend that traders maintain short positions. We initiated these at MYR3,380, the closing level of 13 Nov. To manage risks, we set the stop-loss to be above MYR3,350.

The immediate support is marked at MYR3,234, followed by the low of 10 Nov, which is MYR3,193. Towards the upside, the immediate resistance is pegged at MYR3,337, the low of 13 Nov, followed by MYR3,380.

Source: RHB Securities Research - 23 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024