FCPO - Breaching The Resistance

rhboskres

Publish date: Tue, 24 Nov 2020, 05:59 PM

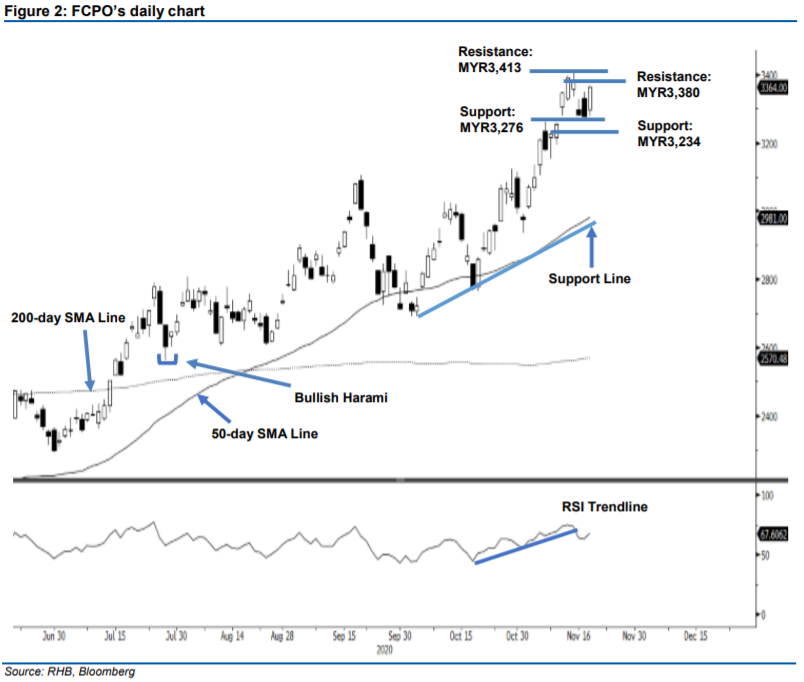

Stop-loss triggered; initiate long positions. The FCPO jumped higher on Wednesday, surging MYR85 to settle at MYR3,364. The commodity started the session with a strong opening, rising MYR20 to open at MYR3,299. However, the commodity was overcome by the bears, pushing it down to the session’s low of MYR3,277, where it continued to hover until the final trading hour. The bulls trumped the bears and pushed the commodity towards the session’s high of MYR3,370, breaching the resistance of MYR3,350. With the latest development, we think that the correction phase or consolidation is over, and the commodity is ready to resume its uptrend. A breach above the immediate resistance will see the commodity challenge the multi-year high of MYR3,413. With the RSI indicator rounding up, the short-term trend looks to be bullish. As such, we switch to a positive trading bias.

Our previous short positions initiated at MYR3,380, or the closing level of 13 Nov – were closed out in the latest session at MYR3,350. Concurrently, we initiate long positions. To manage risks, a stop-loss can be placed below MYR3,276.

The immediate support is marked at the low of 17 Nov, which is MYR3,276, followed by MYR3,234. Towards the upside, the immediate resistance is pegged at MYR3,380, followed by MYR3,413, ie the high of 13 Nov

Source: RHB Securities Research - 24 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024