WTI Crude - Closing in the Multi-Month High

rhboskres

Publish date: Tue, 24 Nov 2020, 10:52 AM

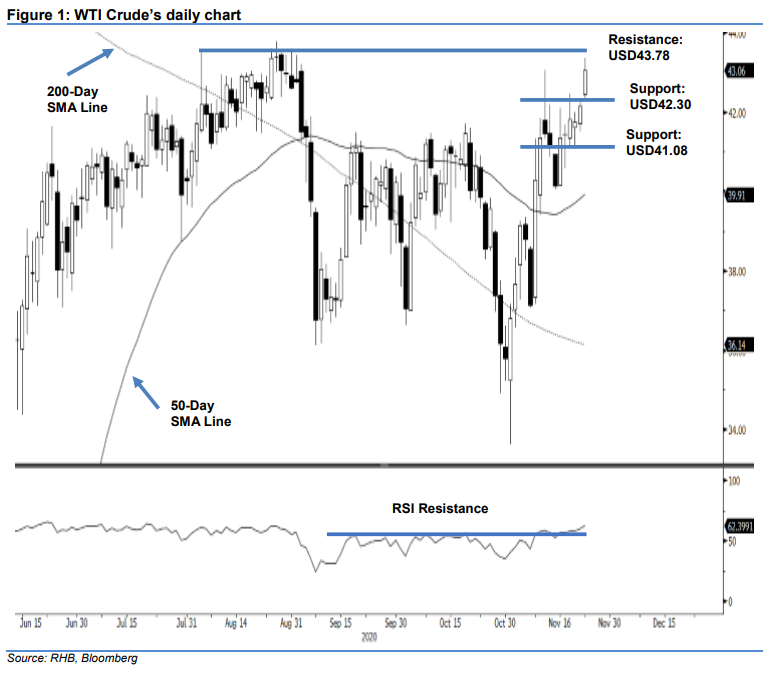

Maintain short positions. The WTI Crude extended its positive closing for the third consecutive session, adding USD0.91 to close at USD43.06 – after reaching a high of USD43.36. The positive performance defied our expectation for the commodity to extend its correction phase to retest the 200-day SMA line, as it marked a higher high vs 11 Nov’s top. Still, we believe that as long as the commodity is still capped by the USD43.78 resistance point, it is still considered as trading within a multi-month correction phase – this implies the risk for the commodity to experience a retracement phase from its current level remains high. Maintain our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD40.13, or the closing level of 13 Nov. To manage risks, a stop-loss can be placed above the USD43.78 threshold.

We revise the immediate support to USD42.30 – near the latest low, followed by USD41.08 – the lows of 18 and 19 Nov. Meanwhile, the immediate resistance is revised to USD43.78, which was 26 Aug’s high. This is followed by USD45.00.

Source: RHB Securities Research - 24 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024