FCPO - Profit-Taking At a High

rhboskres

Publish date: Wed, 25 Nov 2020, 05:46 PM

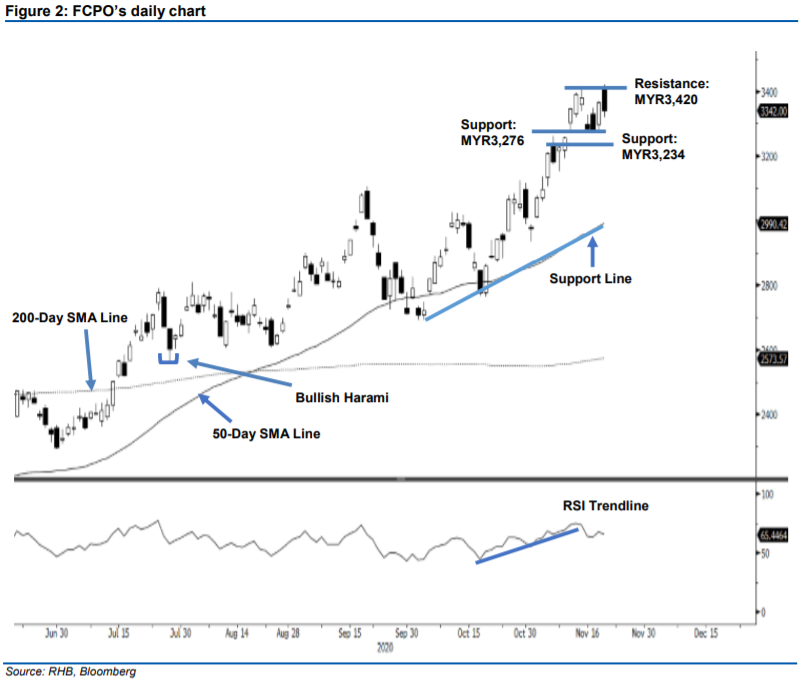

Maintain long positions. The FCPO saw some correction or profit-taking on Thursday, shedding MYR22.00 from the previous session to settle at MYR3,342. The commodity started the session with a positive opening, rising MYR46.00 to open at MYR3,410. However, the bulls were taking the opportunity to pare down their exposure and, coupled with selling pressure from the bears, the FCPO fell from a day high to the day low of MYR3,319. It last traded at MYR3,342. Based on the price action, the bears were respecting the MYR3,337 level, or the low of 13 Nov. As we saw buying interest emerging near this threshold, we think the support zone for the commodity will be between MYR3,276 and MYR3,337. For the bullish trend to be intact, said zone must not be breached in the near term and the momentum indicator RSI should trend up post correction. Since it is still premature to confirm a reversal signal, we maintain a positive trading bias.

We recommend traders switch over to long positions. We initiated these at MYR3,364, or the closing level of 18 Nov. To manage risks, a stop-loss can be placed below the MYR3,276 mark.

The immediate support is marked at the low of 17 Nov, ie MYR3,276, and followed by MYR3,234. Towards the upside, the immediate resistance is pegged at MYR3,380 and followed by the recent MYR3,420 high.

Source: RHB Securities Research - 25 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024