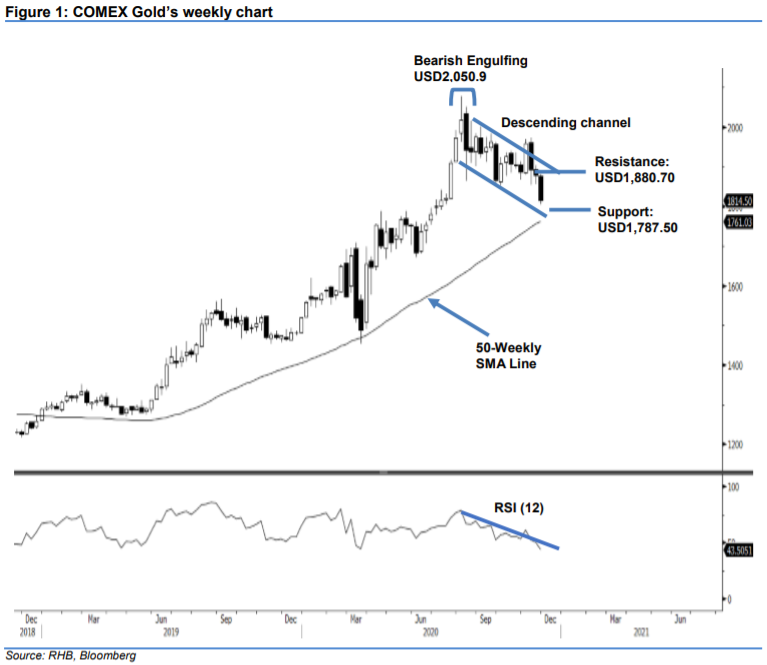

COMEX Gold - Tracking the Descending Channel

rhboskres

Publish date: Fri, 27 Nov 2020, 04:35 PM

Maintain short positions. The COMEX Gold is moving downwards, tracking the decending channel. The correction phase started from USD2,050.90, or the resistance formed by the Bearish Engulfing pattern. Over the past week, the precious metal started trading at USD1,875.90, rebounding slightly to the week high of USD1,880.7. It then touched the week low of USD1,803.70 after breaching the critical support level of USD1,860. The RSI momentum indicator is still moving below the 50% threshold level, indicating further negative momentum ahead. We believe there will be support between the USD1800 and USD1,787.50 levels. Looking at the bigger picture, the uptrending of the 50-week SMA line will provide long term support for the precious metal. In the near term, as the commodity is displaying a ‘lower lows’ pattern, we maintain our negative trading bias.

We recommend traders hold on to short positions. We initiated these at USD1,860.60 on 9 Nov. For riskmanagement purposes and profit protection, a trailing stop can be set above the USD1,838 mark.

Downside support is marked at the USD1,800 round figure, followed by USD1,787.50, or the high of 18 May. On the upside, the immediate resistance is seen at USD1,830, followed by USD1,880.70 – the high of 23 Nov.

Source: RHB Securities Research - 27 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024