WTI Crude - Counter-Trend Rebound Extending

rhboskres

Publish date: Fri, 27 Nov 2020, 04:38 PM

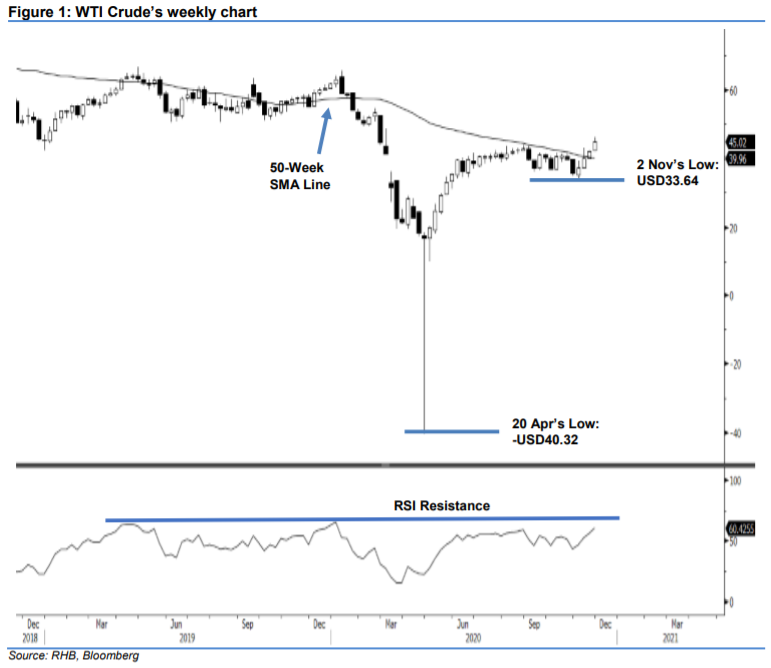

Maintaining long positions. We are taking a look at WTI Crude’s weekly chart in this piece. Overall, we believe the commodity reached its multi-year low in April, with a sharp washout session experienced on 20 Apr, which saw prices reach historic negative levels. From there, the commodity recovered strongly, and hit an interim top at endAugust, at around the 50-week SMA line. From there, it developed a multi-week ABC corrective pattern, below the said SMA line, to reach a low of USD33.64 on 2 Nov. Recent sessions’ positive price actions have pushed the commodity away from the said corrective structure’s trading range, and thus, in our view, confirming that its rebound is likely to extend over the medium-term. However, some minor consolidation is expected to develop in the nearterm following its recent sharp gains.

We recommend traders stay in long positions. We initiated these at USD44.91 – the closing level of 24 Nov. To manage risks, a stop-loss can be now placed at the breakeven mark.

Immediate support is maintained at USD44.50, followed by USD43.50. Moving up, the immediate resistance is eyed at USD47.57 – the high of 5 Mar. This is followed by USD48.66, or the high of 3 Mar.

Source: RHB Securities Research - 27 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024