E-Mini Dow - Long-Term Uptrend Back on Track

rhboskres

Publish date: Fri, 27 Nov 2020, 04:39 PM

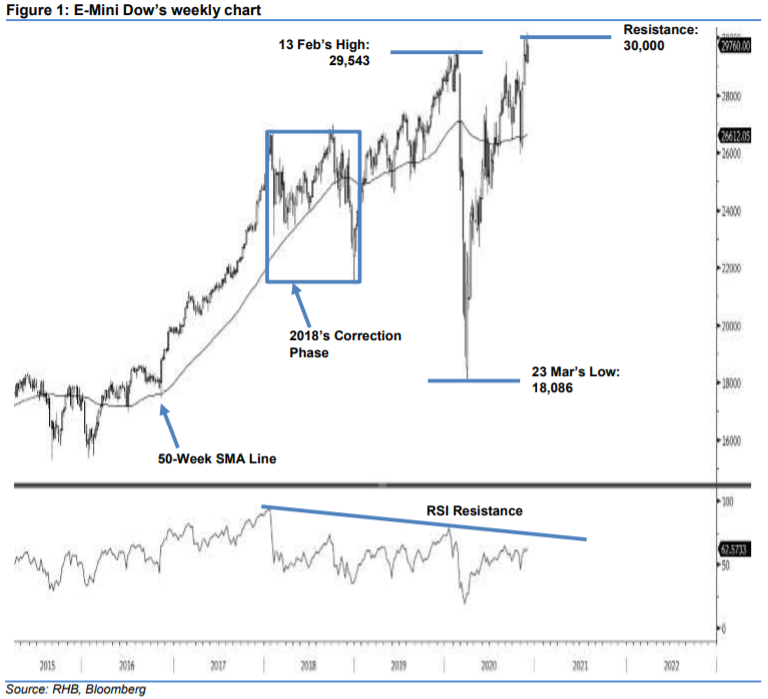

Maintain long positions as index not showing clear signs of reversal. We are revisiting the E-Mini Dow’s longterm price trend in this note. The index’s uptrend from 2016 has seen two significant correction phases. The first was lengthy, lasting for almost the entire 2018, but relatively narrow in nature, in the form of a flat structure - it fell c.20% during the period. The index then resumed its uptrend, which lasted two years, reaching a high of 29,543 pts on 13 Feb. From this point, it entered one of its shortest and sharpest corrections on record, retracing 39% in a span of five weeks, and hitting a low of 18,086 pts on 23 Mar. While the upward move off the said low, over the past few month has been very sharp, the index’s latest attempts to cross above the 30,000-pt level are considered strong, and not showing signs of rejection. Coupled with the healthy daily and weekly RSI readings, and its firm position above both the 50-and 200-day SMA lines, we believe the index is on track to extend its multi-year uptrend.

We recommend traders stay in long positions. We initiated these at 29,998 pts – the closing level of 24 Nov. For risk-management purposes, a stop-loss can be placed below 29,750 pts.

On a short-term basis, support levels are maintained at 29,750 pts and 29,500 pts. The immediate resistance is eyed at the 30,000-pt mark, followed by 30,500 pts.

Source: RHB Securities Research - 27 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024