WTI Crude - Weak Intraday Follow-Through

rhboskres

Publish date: Thu, 03 Dec 2020, 04:20 PM

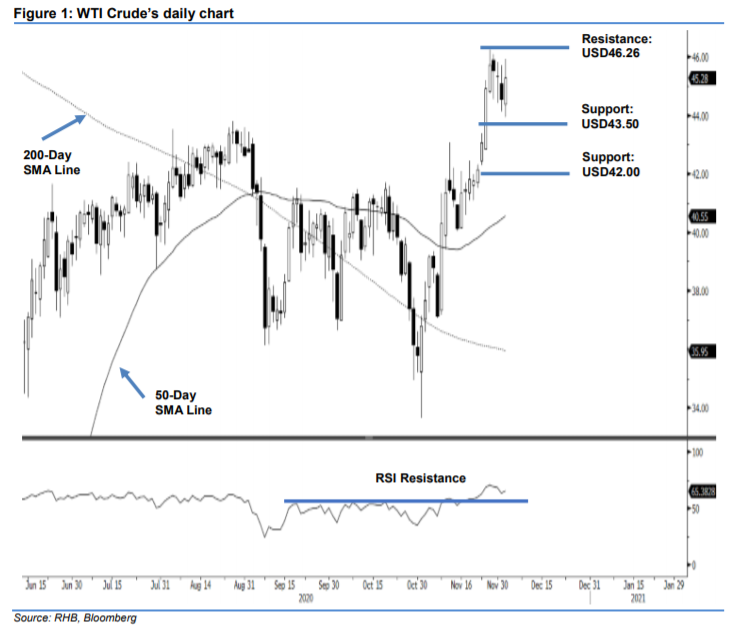

Maintain short positions. The WTI Crude started the session on a weak note, sliding to a low of USD44.12 before rebounding rather strongly to an intraday high of USD45.92. It then gained USD0.73 to settle at USD45.28. Even so, we note that the intraday price actions suggest the lack of a strong follow-through from the bulls in extending the price rebound. By extension, the possibility is still high that the commodity remains in the correction phase – which started from the high of 25 Nov – following the previous round of sharp gains. Our base case expectation, for the correction phase, is for prices to slide towards the USD43.50-USD42.00 support zone. We maintain our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD44.55 – the closing level of 1 Dec. To manage risks, a stop-loss can be placed above USD47.57.

The immediate support is maintained at USD43.50, followed by USD42.00. Conversely, the overhead resistance is set at USD46.26, or the high of 29 Nov, followed by USD47.57, which was the high of 5 Mar.

Source: RHB Securities Research - 3 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024