WTI Crude - Trading Within the Consolidation Phase

rhboskres

Publish date: Fri, 04 Dec 2020, 04:27 PM

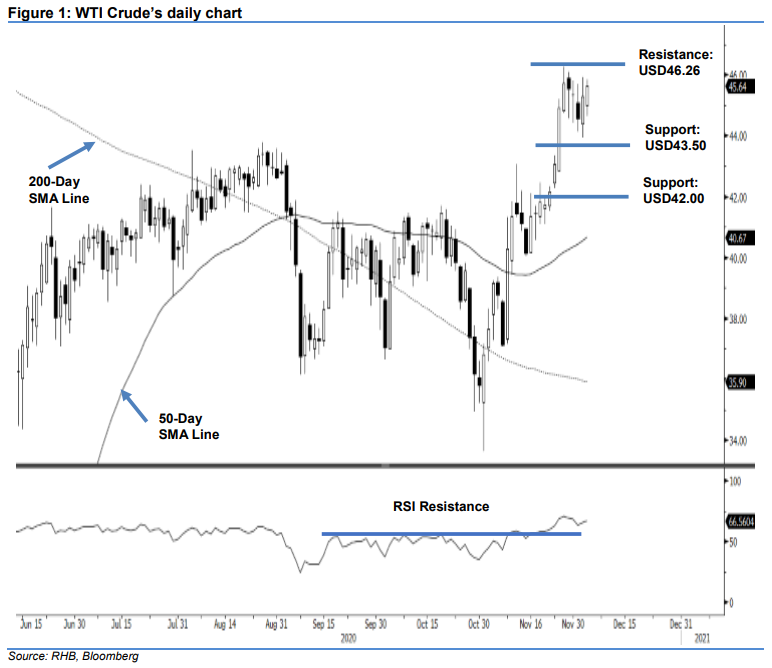

Maintain short positions. The WTI Crude continued to trade within its 1.5-week correction phase. After reaching a low and high of USD44.66 and USD45.84, the black gold settled USD0.36 higher at USD45.64. This correction phase set in following the commodity’s prior multi-week sharp gains. Towards the upside, we are looking at an upside breach of the USD47.57 resistance level as a valid price breakout from the said correction phase, to signal the resumption of its multi-month upward move. Until this happens, we are keeping our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD44.55 – the closing level of 1 Dec. To manage risks, a stop-loss can be placed above USD47.57.

Immediate support is still expected to emerge at USD43.50, followed by USD42.00. Meanwhile, we are keeping the immediate resistance at USD46.26, or the high of 29 Nov, followed by USD47.57, which was the high of 5 Mar.

Source: RHB Securities Research - 4 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024