FKLI - Moving Up The Trailling Stop

rhboskres

Publish date: Fri, 11 Dec 2020, 04:32 PM

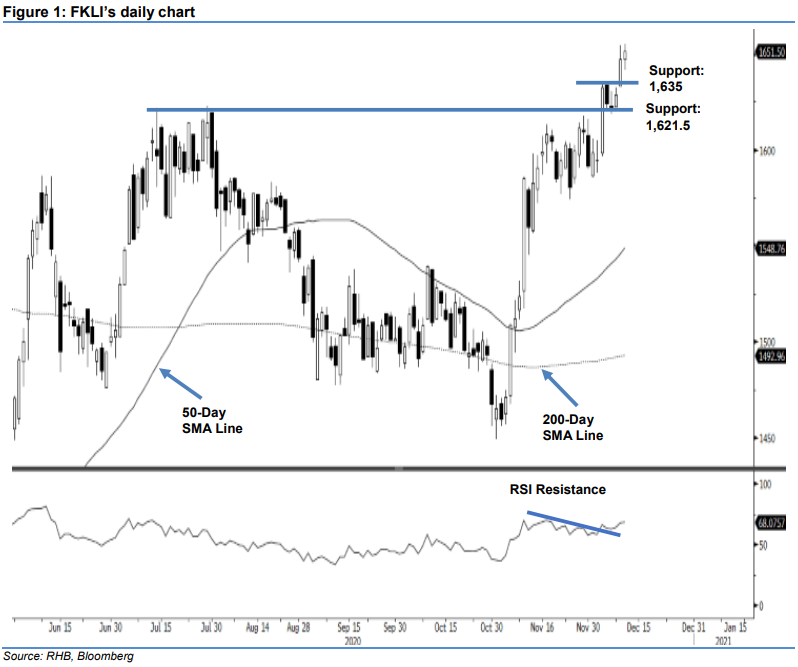

Indecisive break from the immediate resistance; maintain long positions. The FKLI traded in a sideways fashion in the latest session, in the range of 1,641.5 pts and 1,655 pts, before closing 4.5 pts higher at 1,651.5 pts – marginally above the 1,650-pt resistance. The intraday performance suggests the index is consolidating the prior session’s gain, following its breakout from a minor congestion area. We now believe provided the 1,635-pt immediate support is not breached towards the downside, the thesis of the index extending its multi-month upward move would stay intact. Maintain our positive trading bias.

We recommend that traders remain in long positions. We initiated these at 1,611.5 pts, the closing level of 26 Nov. To manage risks, a stop-loss can be set below 1,635 pts.

The immediate support is maintained at 1,635 pts – the high of 3 Dec, followed by 1,621.5 pts, the high of the previous “Double Top” formation in July. Conversely, we are keeping the immediate resistance target at 1,650 pts as it was not decisively crossed in the latest session, followed by 1,665 pts.

Source: RHB Securities Research - 11 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024