Hang Seng Index Futures - Testing the Upside Resistance

rhboskres

Publish date: Fri, 11 Dec 2020, 04:37 PM

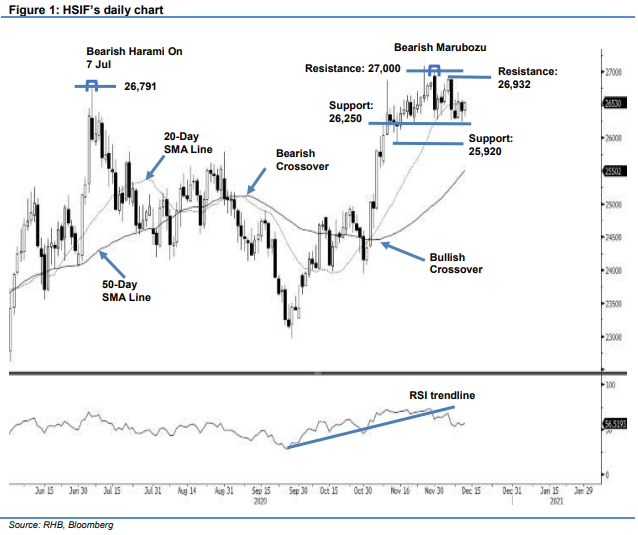

Maintain short positons. The HSIF formed a hammer pattern yesterday, testing the boundaries of the 20-day SMA line. The index gapped up 50 pts from the previous evening’s session to start at 26,290 pts. The sentiment became bullish, which saw the HSIF rising to the day high of 26,449 pts. The evening session continued to see the index further rebounding to the session high of 26,542 pts – it last traded at 26,530 pts. Despite a positive price action by both the day and evening sessions, we still think the Bearish Marubozo pattern – which formed on 30 Nov and 7 Dec – have not weakened yet. With the RSI momentum yet to see a higher high pattern, the HSIF should see more consolidation along the 20-day SMA line in the coming sessions. As such, we keep to our negative trading bias.

We recommend traders maintain short positions. We initiated such positions at 26,427 pts, or the closing level on 7 Dec. For risk-management purposes, a stop-loss can be placed above the 26,932-pt level.

The immediate support is marked at 26,250-pt round figure and followed by 25,920 pts. On the upside, the immediate resistance is pegged at the recent high of 26,932 pts and followed by the next hurdle at 27,000 pts.

Source: RHB Securities Research - 11 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024