FKLI - Further Tightening Risk Management

rhboskres

Publish date: Mon, 14 Dec 2020, 08:58 AM

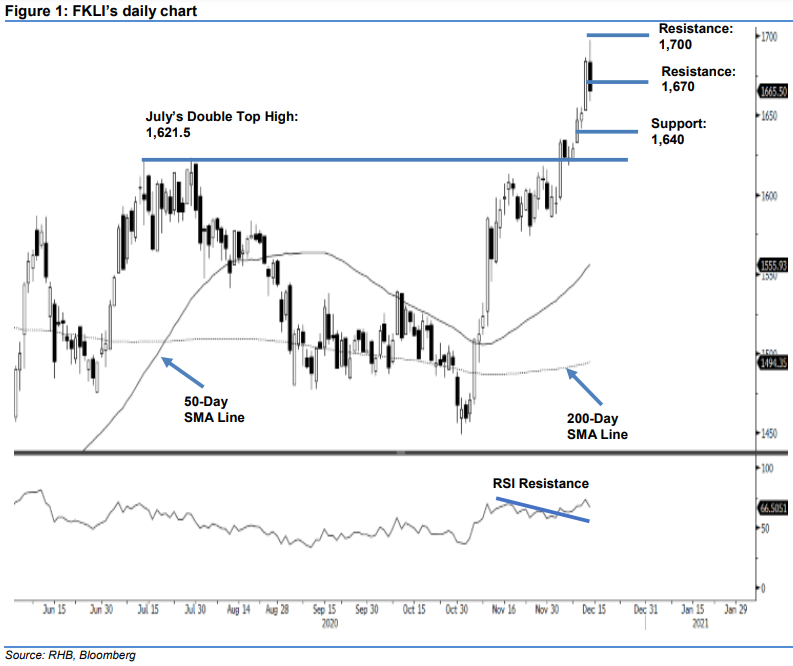

Maintain long positions. The FKLI generally trended higher for the whole of last Friday’s session to close 33 pts stronger at 1,684.5 pts, near the session’s high of 1,686.5 pts – this also marks its highest close since Jul 2019. The strong performance illustrates the bulls’ firm control over the price trend following the recent breakaway from July’s “Double Top” formation. However, given that the index is approaching the next critical resistance level of the 1,700-pt mark on the back of the now overbought RSI reading, the possibility of profit taking activities setting in has also increased. Towards the downside, should the 1,670-pt support level give way, this would signal the commencement of a correction phase. For now, we are keeping our positive trading bias.

We recommend that traders remain in long positions. We initiated these at 1,611.5 pts, the closing level of 26 Nov. To manage risks, a stop-loss can be set below 1,670 pts.

Support levels are revised to 1,670 pts – price point of the latest session, this is followed by 1,650 pts. Towards the upside, the immediate resistance is pegged at the round figure of 1,700 pts, followed by 1,730 pts.

Source: RHB Securities Research - 14 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024