WTI Crude - Bulls Hesistating Near Resistance Level

rhboskres

Publish date: Mon, 14 Dec 2020, 09:19 AM

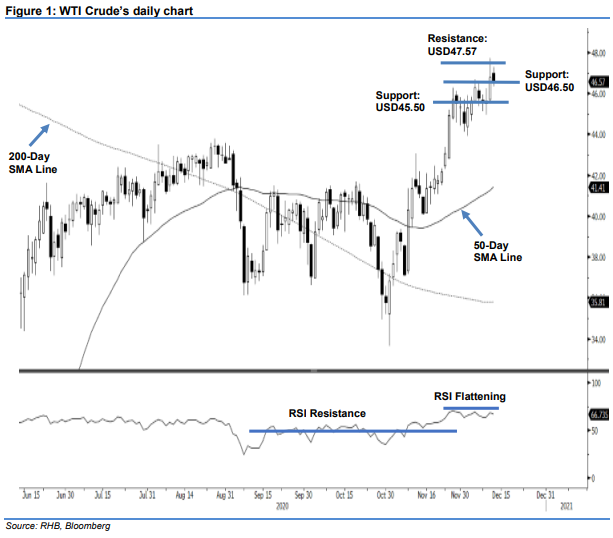

Maintain short positions. The WTI Crude is taking a pause from the rally, retracing USD0.21 from Thursday’s session to settle at USD46.57. The commodity had a positive opening last Friday, gapping USD0.19 higher to start at USD46.97. Despite the bullish opening, it saw selling pressure emerge near the session’s high of USD47.29, resulting in the commodity closing lower at USD46.57. Although it has been rising recently, the RSI momentum indicator failed to follow suit. The RSI indicator is seen flattening, and showing divergence from the commodity price trend. This suggests that the commodity may not trend higher, and is due for a correction soon. As long as the upside resistance stays intact, we will maintain our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD44.55, or the closing level of 1 Dec. To manage risks, a stop-loss can be placed above the USD47.57 threshold.

The immediate support is marked at USD46.50, followed by USD45.50, which was near the low of the latest session. On the upside, the immediate resistance is set at USD47.57, followed by USD48.66, or the high of 3 Mar.

Source: RHB Securities Research - 14 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024