FKLI - Negative Intraday Reversal

rhboskres

Publish date: Tue, 15 Dec 2020, 08:55 AM

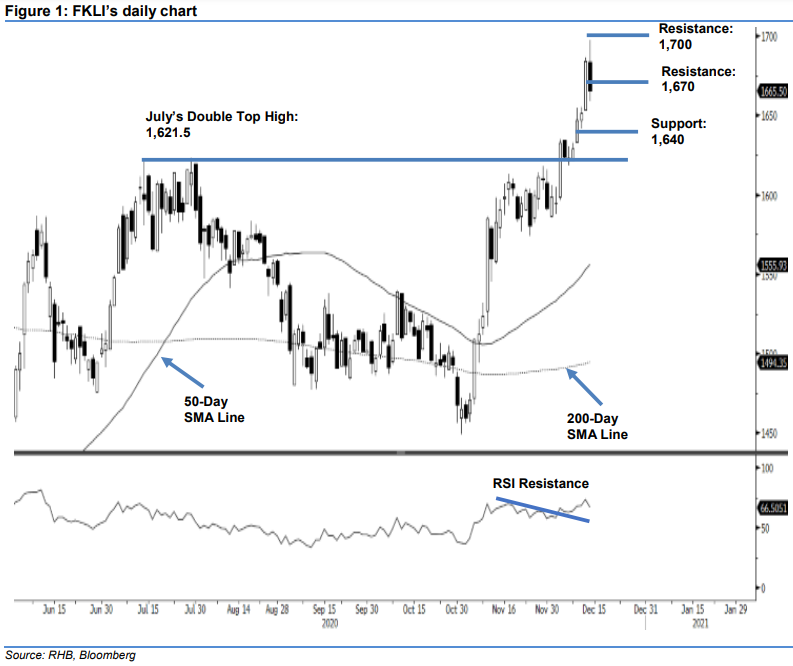

Initiate short positions on possible correction phase kicking in. The FKLI experienced a negative intraday price reversal after coming in near to test the 1,700-pt resistance level. It reached a high of 1,697.5 pts earlier in the session before sliding lower for the rest of the session to close 19 pts weaker at 1,665.5 pts. The price weakness confirms our view that the index was at risk of experiencing profit taking activity around the 1,700-pt level, following its past two weeks’ sharp gains, which pushed the RSI into the overbought threshold. With the downside breach of the previous immediate support of 1,670 pts, we believe the index has reached its interim top and that its next bigger move is now tilted towards the downside. Our base case expectation is for this correction phase to run for weeks. Switch our trading bias from positive to negative.

Our previous long positions were initiated at 1,611.5 pts, the closing level of 26 Nov, were closed out at 1,670 pts in the latest session. Concurrently, we initiate short positions. To manage risks, a stop-loss can be set above 1,700 pts.

Support levels are revised to 1,640 pts and 1,621.5 pts – the latter being July’s “Double Top” high. Meanwhile the immediate resistance is pegged at 1,675 pts, followed by the round figure of 1,700 pts.

Source: RHB Securities Research - 15 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024