COMEX Gold - Moving Lower With Negative Momentum

rhboskres

Publish date: Tue, 15 Dec 2020, 09:05 AM

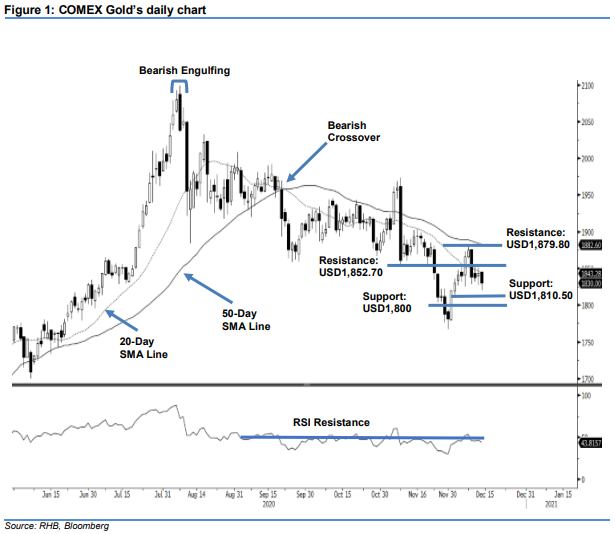

Maintain short positions. The COMEX Gold saw the trading range increase yesterday, falling USD13.60 from the previous session, to settle at USD1,830. The commodity opened on a positive note, gapping USD1.40 to start at USD1,845. However, once the session started, selling pressure took place, and the commodity slipped to the day low of USD1,820 – breaching the USD1,824.80 support level. Halfway into the session, buying interest emerged near the day low, propping up the precious metal to close at USD1,830. With the latest price action, we think the negative momentum is gaining traction, as the RSI indicator is pointing south. Furthermore, the gap between the 20-day and 50-day SMA lines is widening, indicating more selling pressure ahead. We expect to see more downside correction in the coming sessions. As such, we maintain our negative trading bias.

We recommend that traders maintain short positions. We initiated these at USD1,838.50, or the closing level of 9 Dec. For risk-management purposes, a stop loss can be set above the USD1,860 level.

Downside support is marked at 2 Dec’s low of USD1,810.50, followed by USD1,800. On the upside, the immediate resistance is pegged at 4 Dec’s high of USD1,852.70, followed by USD1,879.80.

Source: RHB Securities Research - 15 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024