WTI Crude - Bulls Win the Wild Session

rhboskres

Publish date: Tue, 15 Dec 2020, 09:09 AM

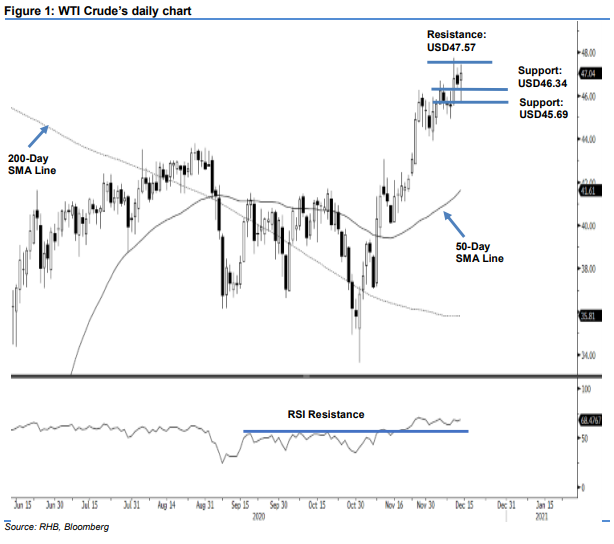

Maintain short positions. The WTI Crude had a volatile session, with the bulls reversing from the session’s low of USD45.69, to end the day USD0.47 higher at USD47.04. Looking at the lower time frame, the commodity is showing signs of attempting to end its recent sessions’ minor correction phase. Towards the upside, should the commodity settle above the USD47.57 immediate resistance level, it would signal that the multi-week advancement may be able to extend much further. A failure to do so, would expose the commodity to the risk of further correction, following the sharp gains seen between early-November and early-December. For now, we keep our negative trading bias.

We recommend that traders stay in short positions. We initiated these at USD44.55, or the closing level of 1 Dec. To manage risks, a stop-loss can be placed above the USD47.57 threshold.

Immediate support is revised to USD46.34, followed by USD45.69 – both derived from the latest candle. On the upside, the immediate resistance is maintained at USD47.57, followed by USD48.66, or the high of 3 Mar.

Source: RHB Securities Research - 15 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024