Hang Seng Index Futures - Testing the Upside Resistance Again

rhboskres

Publish date: Thu, 17 Dec 2020, 04:19 PM

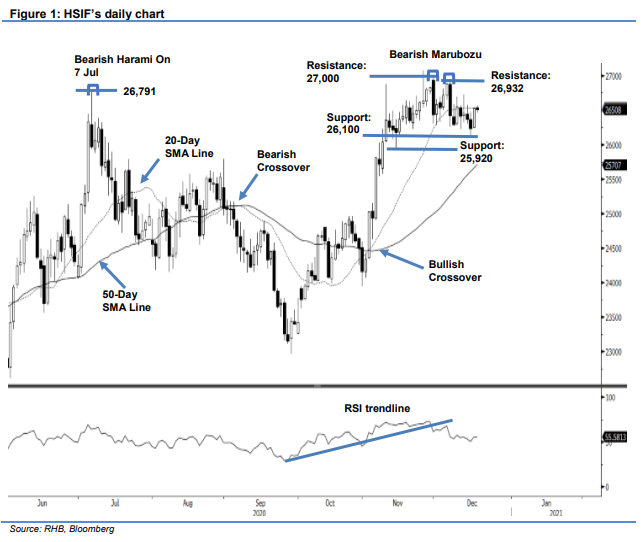

Maintain short positions. The HSIF rebounded yesterday, to settle at 26,530 pts. On Wednesday morning, the index opened flat at 26,352 pts. Selling pressure was seen early in the session, and the index fell to the day low of 26,306 pts. The bulls found footing near this point, pushing the index higher to settle at 26,530, after testing the 26,538-pt day high. The evening session was muted, closing at 26,508 after bouncing between 26,460 pts and 26,570 pts. Since 30 Nov, or the formation of the Bearish Marubozu, the index has been moving in a “lower highs” and “lower lows” bearish pattern. We think the index needs to breach the 26,932-pt Bearish Marubozu resistance level to resume the uptrend. We also expect selling pressure to arise when it nears the overhead 20-day SMA line or the upside resistance. As such, we keep our negative trading bias.

We recommend that traders stick to short positions. We initiated these at 26,427 pts, or the closing level of 7 Dec. For risk-management purposes, a stop-loss can be placed above 26,932 pts.

The immediate support is unchanged at the recent low of 26,100 pts, followed by 25,920 pts. On the upside, the immediate resistance is pegged at 7 Dec’s high of 26,932 pts, followed by the round figure hurdle of 27,000 pts.

Source: RHB Securities Research - 17 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024