FKLI - Correction Phase Is Extending

rhboskres

Publish date: Mon, 21 Dec 2020, 08:42 AM

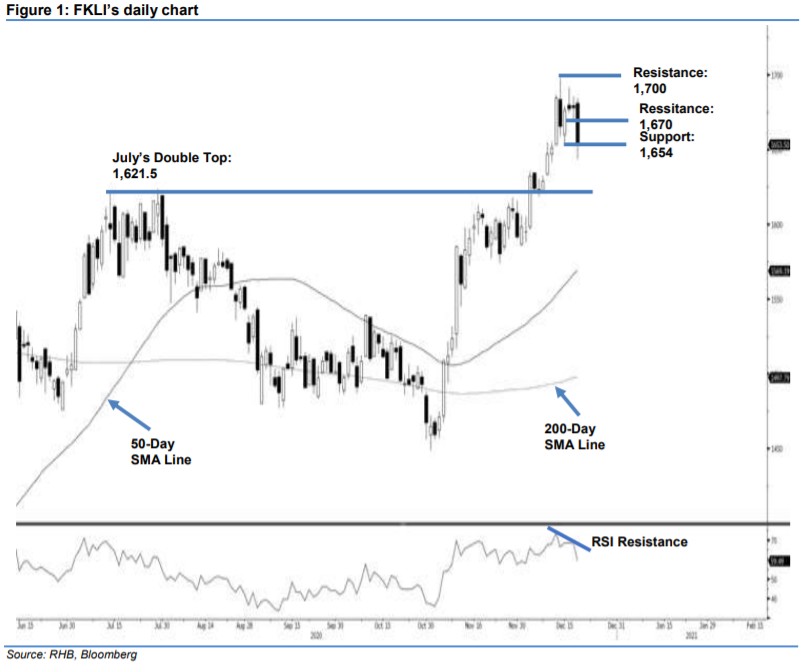

Bears exerted muscle; maintain short positions. Last Friday, the FKLI dropped to an intraday low of 1,643.5 pts, before rebounding to close at 1,653.5 pts. This session marked a decline of 24.5 pts. The closing level placed the index slightly below its second support of 1,654 pts. The weak session was in line with our expectation that the index is developing a multi-week correction phase, which we expect to retest July’s “Double Top” high. However, given the sharp 1-week decline of 54 pts (the difference between its high and low points), a minor rebound may likely take place in the coming 1-2 sessions. However, we still expect to see a bigger downward move ahead, and maintain a negative trading bias.

We recommend that traders stick to short positons. We initiated these at 1,665.5 pts, the closing level of 14 Dec. To manage risks, a stop-loss can be set above 1,700 pts.

The immediate support is revised to 1,654 pts as it was not decisively breached. This is followed by 1,621.5 pts – the high of July’s “Double Top”. Towards the upside, the immediate resistance is envisaged at 1,670 pts – the high of 16 Dec – followed by 1,700 pts.

Source: RHB Securities Research - 21 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024