WTI Crude - Bulls Are Holding Up

rhboskres

Publish date: Tue, 22 Dec 2020, 08:47 AM

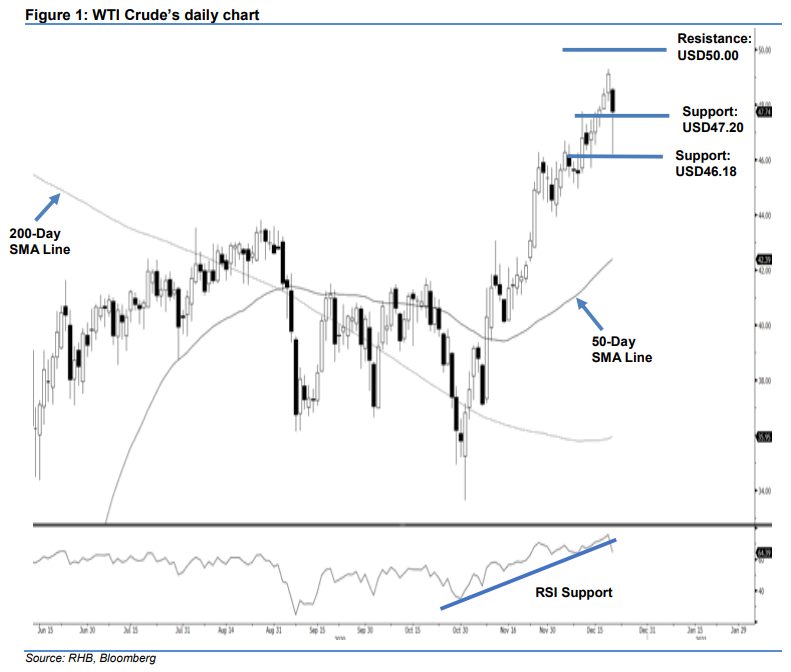

Maintain long positions. The WTI Crude experienced a volatile trading session, which saw it end USD1.36 lower at USD47.74. Earlier, it had slid to a low of USD46.18. The session saw one of the widest trading ranges in recent weeks, and also marked the end of the commodity’s one-week winning streak. This was also in line with our earlier caution that the black gold was at risk of profit-taking activities, as its RSI saw an overbought reading near the USD50.00 psychological level last Friday. However, to signal a deeper correction phase, further negative price actions are needed in the coming sessions. For now, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD47.62, which was the closing level of 15 Dec. To manage risks, a stop-loss can now be placed at the breakeven point.

The immediate support is revised to USD47.20 and USD46.18 – both derived from the latest candle. Moving up, the immediate resistance is now set at USD48.20, followed by the USD50.00 round figure.

Source: RHB Securities Research - 22 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024