WTI Crude - Shorting the Retracement

rhboskres

Publish date: Wed, 23 Dec 2020, 04:33 PM

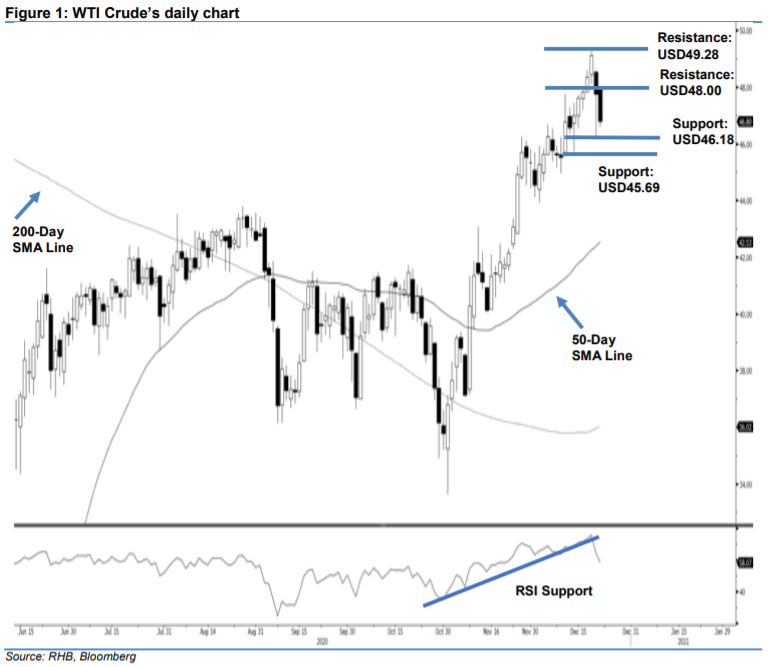

Initiate short positions. The WTI Crude was unable to sustain its earlier session’s positive tone, which saw prices hitting a USD47.96 high. The commodity was driven down from this point, reaching a low of USD46.60, before narrowing its losses by USD0.94 to settle at USD46.80. The closing level also breached below the previous USD47.20 immediate support and, in our view, signalled that a possible deeper correction phase is likely developing. This came after the black gold experienced a sharp multi-week upward move and saw its RSI hitting the overbought threshold near the USD50.00 psychological level. Towards the downside, we are expecting prices to retrace towards the USD43.00-44.00 area. We switch our trading bias to negative from positive.

Our previous long positions were initiated at USD47.62 – the closing level of 15 Dec – and closed out at the break even. Concurrently, we initiate short positons. To manage risks, a stop-loss can be placed above USD49.28.

The immediate support is revised to USD46.18 and followed by USD45.69, or the low of 14 Dec. On the upside, the immediate resistance is revised to USD48.00 and followed by USD49.28, ie the high of 18 Dec.

Source: RHB Securities Research - 23 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024