FKLI - Nearing The Retracement Target

rhboskres

Publish date: Wed, 23 Dec 2020, 04:34 PM

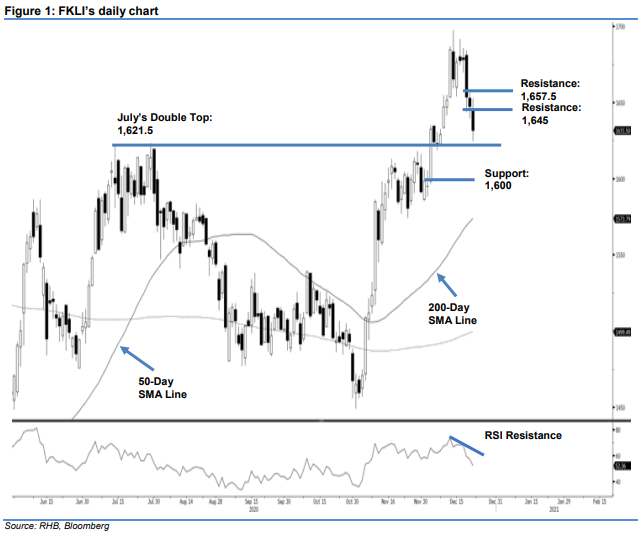

Maintain short positions. The FKLI continued to be dominated by the bears yesterday, and bulls did not look like they could stage a counter-trend rebound despite the relatively sharp decline of 4.3% over the past 1.5 weeks. The index tested the 1,624.5 pts twice – a level near our retracement target of 1,621.5 pts – before rebounding to narrow losses to 16 pts. It closed at 1,631.5 pts. Despite closing 7 pts above the intraday low after testing it twice, this would not be a sufficient sign that a counter-trend is in the wings. We still believe this correction phase – which started near the 1,700- pt level – may remain in effect for weeks, with counter-trend rebounds expected during a correction. Until signs of these emerge, however, we make no change to our negative trading bias.

We recommend that traders stick to short positons. We initiated these at 1,665.5 pts, the closing level of 14 Dec. To manage risks, a stop-loss can be set at the breakeven mark.

The immediate support is maintained at 1,621.5 pts – the high of July’s “Double Top”. This is followed by the round figure of 1,600 pts. Towards the upside, the immediate resistance is revised to 1,645 pts, followed by 1,657.5 pts – 21 Dec’s high

Source: RHB Securities Research - 23 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024