WTI Crude - Retest Upside Resistance

rhboskres

Publish date: Thu, 24 Dec 2020, 04:47 PM

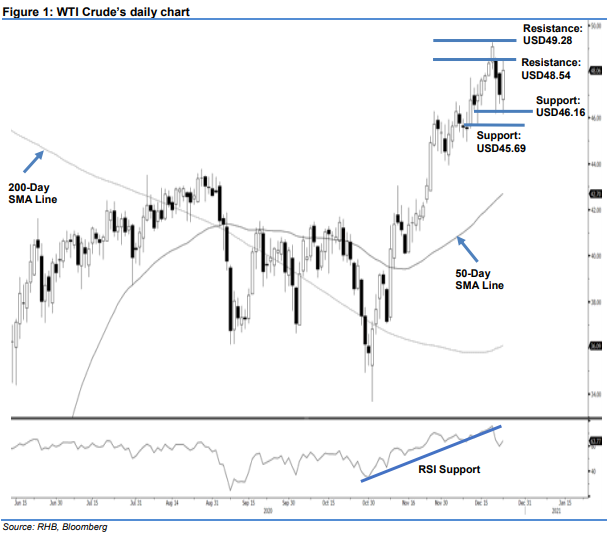

Maintain short positions. The WTI Crude saw a rebound play yesterday, jumping USD1.04 to close at USD48.06. The commodity initially had a shaky start, gapping USD0.23 lower to open at USD46.79 and slid to the day low USD46.16. Buying interest emerged near day low and saw the commodity paring the losses and reverse to the day high at USD48.50. Profit taking activities took place near the day high and saw commodity retrace to close at USD48.06. Combining last two sessions, we are seeing a bullish candlestick formation known as Bullish Engulfing. If the bullish rebound could extend further, the Black Gold might test the upside resistance at USD49.28. Meanwhile, the RSI also turned higher, indicate that immediate term momentum could turned positive in coming sessions. As long as the stop loss level remain intact, we will maintain negative trading bias.

We recommend traders to shift to short positions. Our short positions initiated at USD47.02, or the closing level on 22 Dec. To manage risks, a stop-loss can be placed above USD49.28.

The immediate support is revised to USD46.16, and followed by USD45.69 – the low of 14 Dec. On the upside, the immediate resistance is revised to USD48.54, this is followed by USD49.28 – the high of 18 Dec.

Source: RHB Securities Research - 24 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024