RHB Retail Research

Trading Stocks - British American Tobacco (Malaysia)

rhboskres

Publish date: Mon, 28 Dec 2020, 08:48 AM

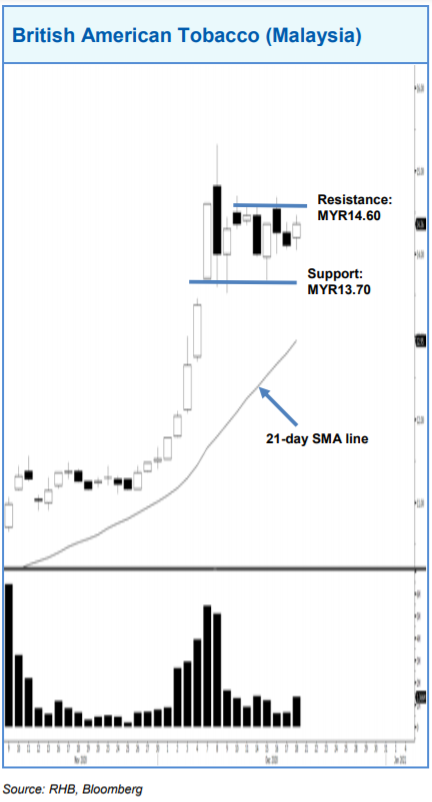

British American Tobacco (Malaysia) is consolidating sideways. Last Friday, it attempted to break out from the resistance. Trading volume also picked up, indicating positive buying interest. If the stock breaks out from the immediate resistance marked at MYR14.60, the uptrend should resume and send the share price higher to test the next hurdle of MYR15.30, followed by MYR16.00. A downside breach of the MYR13.70 support would negate this expectation, and trigger a stock price correction.

Source: RHB Securities Research - 28 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments