WTI Crude - Consolidating Near the Resistance

rhboskres

Publish date: Wed, 30 Dec 2020, 05:13 PM

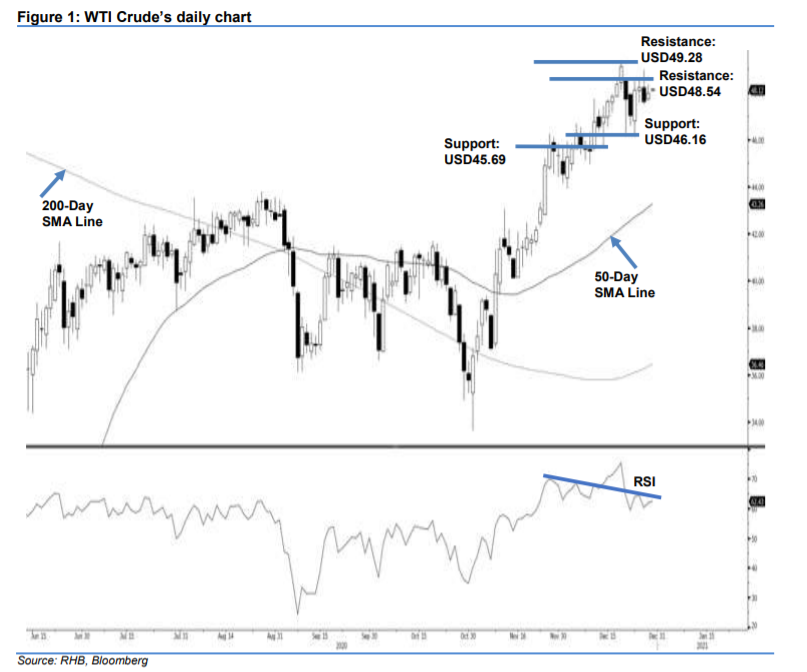

Maintain short positions. The WTI Crude moved sideways yesterday, inching USD0.32 from Monday’s session to settle at USD48.00. The commodity initially had a flat opening at USD47.72 but, during intraday, the bulls did push the black gold to test the day high at USD48.35. However, it hesitated to cross the resistance and retraced to close at USD48.00. With the RSI indicator trending lower, we think the WTI Crude needs further consolidation before it can cross the overhead resistance. There is a possibility that it might pull back lower to re-test the lower support near USD46.00. As long as it trades below the resistance level, we maintain our negative trading bias.

We recommend traders maintain short positions. Our short positions were initiated at USD47.02, or the closing level on 22 Dec. To manage risks, a stop loss can be placed above the USD49.28 level.

The immediate support is marked at USD46.16 and followed by USD45.69, ie the low of 14 Dec. On the upside, the immediate resistance is pegged at USD48.54. This is followed by USD49.28, or the high of 18 Dec.

Source: RHB Securities Research - 30 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024