FKLI - Momentum Stays Neutral

rhboskres

Publish date: Thu, 31 Dec 2020, 04:51 PM

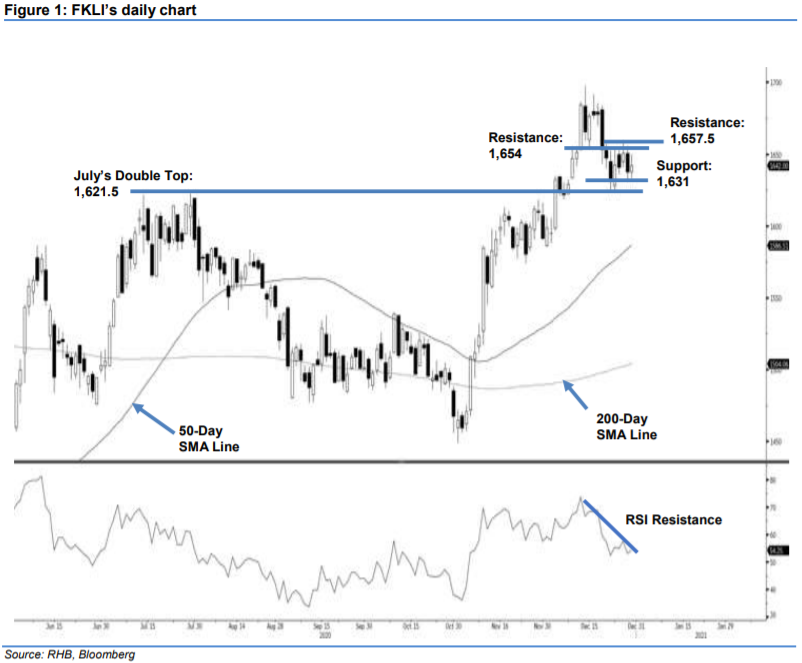

Maintain short positions. The FKLI has seen momentum grow weaker, only managing to recover 4.5 pts from the previous session to settle at 1,642 pts. It opened flat yesterday at 1,637.5. Both bull and bear forces were neutral and the index closed at 1,642 pts after testing the day high and low at 1,650 pts and 1,633 pts. During the last four sessions, the RSI indicator moved lower, showing waning momentum. Without strong buying interest, the bulls cannot pierce through the overhead resistance. Meanwhile, the bears are adopting a wait-and-see approach; so far we have not seen any huge selling pressure yet. Moving into Thursday, which is the last session for December contracts, we are looking to see if the FKLI can do one final push to cross the resistance. With the resistance still remaining intact, we keep to our negative trading bias.

We recommend traders maintain short positons. We initiated these at 1,665.5 pts, ie the closing level of 14 Dec. To manage risks, we adjust the stop loss to above 1,656 pts.

The immediate support is marked at 29 Dec’s low – 1,631 pts – and followed by 1,621.5 pts, or the high of July’s “Double Top”. On the upside, the resistance is pegged at 23 Dec’s high of 1,654 pts and followed by 21 Dec’s high of 1,657.5 pts.

Source: RHB Securities Research - 31 Dec 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024