FKLI - More Corrections Ahead

rhboskres

Publish date: Mon, 04 Jan 2021, 08:42 AM

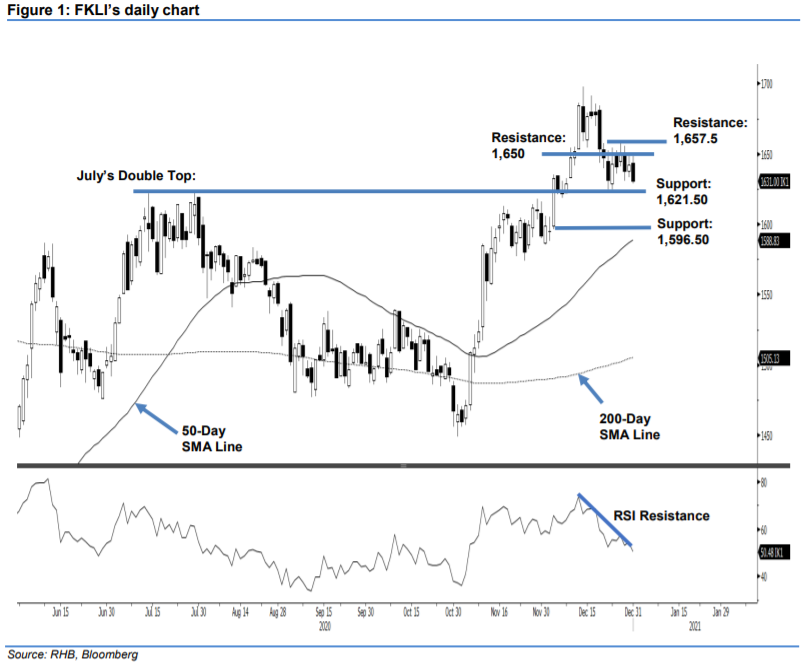

Maintain short positions. The FKLI dipped further on the last trading day of 2020, retracing 10.5 pts from the previous session to settle at 1,631.50 pts. It opened at 1,643.5 pts last Thursday. The bulls tried to stage a rebound, testing the day’s high of 1,648.50 pts. However, tracking the regional peers on profit-taking, the tide changed at mid-day, retracing and falling to the day’s low of 1,628.50. The last traded level was 1,631 pts. Based on latest price action, the index remains constrained by the downtrending of the RSI, where momentum is weakening. In the coming sessions the index might re-test the downside support levels of 1,621.50 pts and 1,596.50 pts – since it is moving in a corrective phase with a “lower highs and lower lows” pattern. Although the trend is generally positive – evidenced by the 50-day SMA line trending upwards – we maintain a negative trading bias during this corrective phase.

We recommend that traders maintain short positons. We initiated these at 1,665.5 pts, ie the closing level of 14 Dec. To manage risks, a stop-loss can be placed above 1,656 pts.

The immediate support is marked at the Double Top resistance-turned-support – 1,621.50 pts – followed by 1,596.5 pts. On the upside, the resistance is pegged at 30 Dec’s high of 1,650 pts, followed by 21 Dec’s high of 1,657.5 pts.

Source: RHB Securities Research - 4 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024