Hang Seng Index Futures - Setting Its Sights Higher

rhboskres

Publish date: Mon, 04 Jan 2021, 09:00 AM

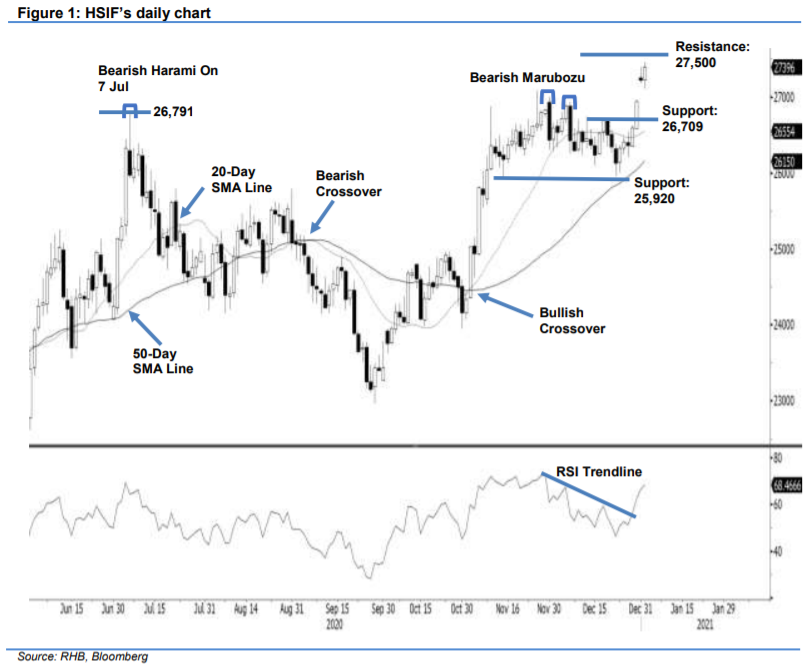

Maintain long positions. After Wednesday’s breakout, the HSIF saw mild consolidation last Thursday, falling 67 pts to settle at 27,219 pts. On Thursday, the index rolled into the Jan 2021 futures contract, opening at 27,239 pts. It rose to the day high of 27,396 but later retraced, dipping to the day low of 27,182. It was last traded at 27,219 pts. As Thursday was New Year’s eve, it was only a half day trading session. Based on the latest price actions, we think the bears were washed out during Wednesday’s breakout. Although the bears may not be giving up, we expect a healthy pull-back or minor retracement in coming sessions. The index may retest the low near the support level of 26,709 pts before aiming for the higher resistance levels of 27,500 and 27,613. As such, we maintain our positive trading bias.

We recommend traders switch over to long positions. We initiated these at 26,943 pts, or the closing level of 30 Dec 2020. For risk-management, a stop-loss can be placed below 26,500 pts.

The immediate support is revised to 17 Dec’s high of 26,709 pts, followed by 25,920 pts. On the upside, the immediate resistance is pegged at the 27,500-pt round figure, followed by the next hurdle at 27,613 pts.

Source: RHB Securities Research - 4 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024