FKLI - Moving In a Correction Phase

rhboskres

Publish date: Tue, 05 Jan 2021, 08:51 AM

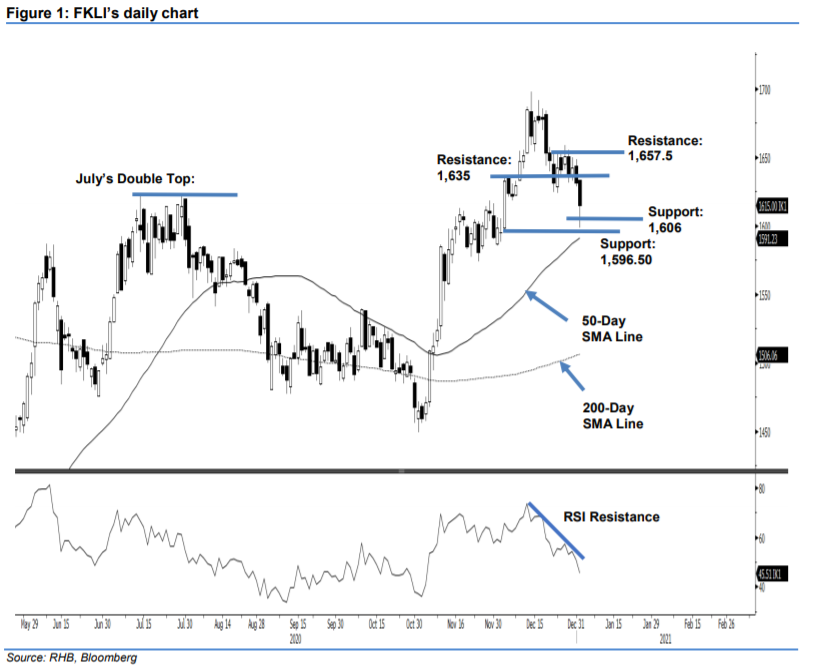

Maintain short positions. The first trading day of 2021 saw massive selling, which led the FKLI to shed 15 pts from the previous session. The index closed at 1,615 pts yesterday. When the session began, the FKLI gapped up to open at at 1,633.5 pts. 15 minutes later, intense selling brought down the index towards the day’s low of 1,598.50, breaching the physcological support level of 1,600 pts. The bears then took a breather, and the index rebounded slightly to close at 1,633.50. The latest price action reaffirms our view that the index is currently in a correction phase, with a “lower lows and lower highs” price pattern. With the RSI pointing downwards and below the 50% threshold, we believe that bullish influence should be weaker than that of the bears ahead. There may still be a rebound, but we do not expect to see a higher high being charted. Unless the resistance levels are breached, we make no change to our negative trading bias.

We recommend that traders maintain short positons. We initiated these at 1,665.5 pts, ie the closing level of 14 Dec. To manage risks, stop loss can be placed above 1,656 pts.

The immediate support is marked at 1 Dec’s high – 1,606 pts, followed by 1,596.5 pts. Towards the upside, the resistance is pegged at 3 Dec’s high of 1,635 pts, followed by 21 Dec’s high of 1,657.5 pts.

Source: RHB Securities Research - 5 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024