WTI Crude - Negative Intraday Price Reversal

rhboskres

Publish date: Tue, 05 Jan 2021, 09:09 AM

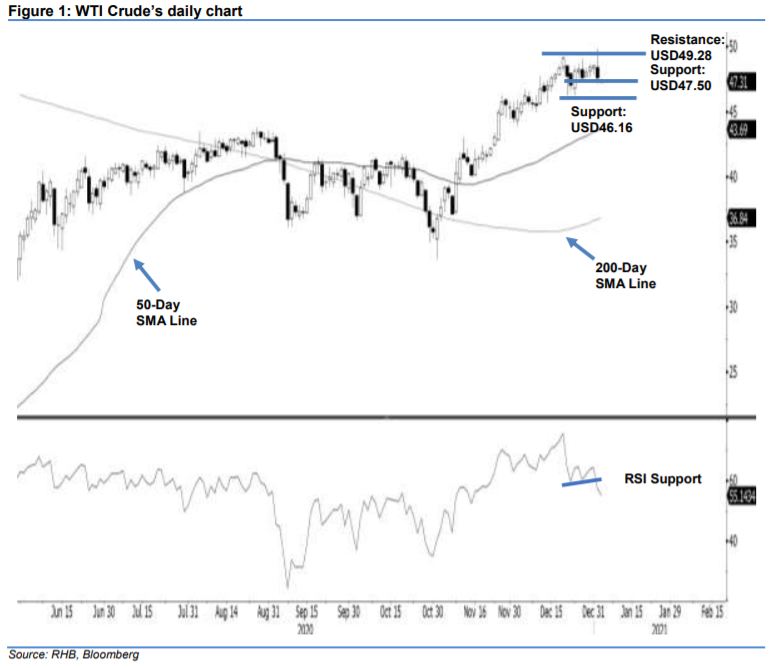

Maintain short positions. The WTI Crude briefly breached above the USD49.28 resistance point, with a high of USD49.81 – near the USD50.00 psychological level – before reversing sharply to settle USD0.90 weaker at USD47.62. The sharp intraday negative price reversal, from the USD49.28 - USD50.00 resistance zone, indicate that the risk of the commodity trading in a correction phase remains high. Furthermore, the RSI has breached its previous support line. Towards the downside, we see strong possibility for the black gold to retest the 200-day SMA line. We maintain our negative trading bias.

We recommend traders maintain short positions. These were initiated at USD47.02, or the closing level of 22 Dec 2020. To manage risks, a stop-loss can be placed above the USD49.28 mark.

Support levels remain at USD47.50, or the low of 28 Dec 2020, followed by USD46.16, which was the low of 23 Dec 2020. On the upside, immediate resistance is set at USD49.28, or 18 Dec 2020’s high, followed by USD50.00.

Source: RHB Securities Research - 5 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024