FKLI - Testing 50-Day SMA Line Support

rhboskres

Publish date: Wed, 06 Jan 2021, 04:19 PM

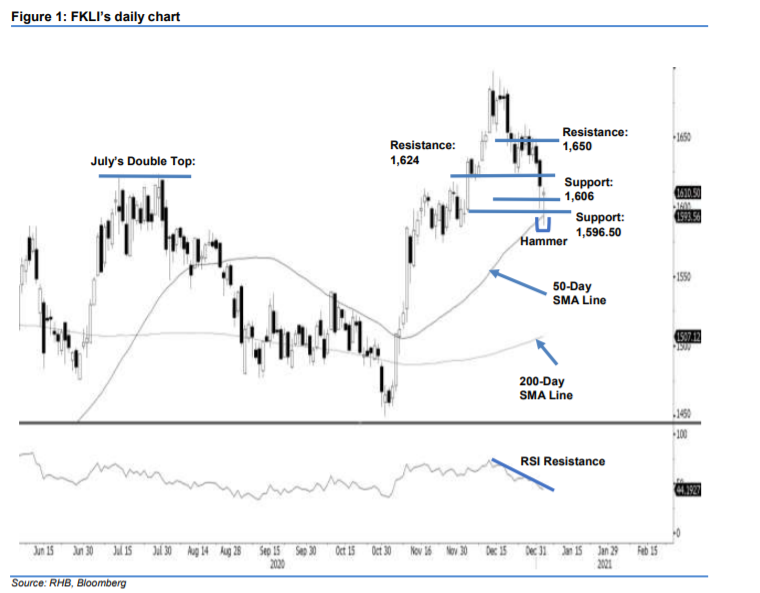

Maintain short positions. The FKLI rebounded from the 50-day SMA line yesterday, but still recorded a loss of 4.5 pts to settle at 1,610.50 pts. The index had a shaky start during the early session, and gapped down to open at 1,609 pts before sliding to the day’s low of 1,587 pts. However, tracking the bullish sentiment on regional peers, buying interest emerged in the afternoon, paring down losses to rebound towards the day’s high of 1,614 pts. Buying pressure emerged near the support levels of 1,606 and 1,596.50 pts. The index also reacted positively on the support level of the 50-day SMA line, by forming a bullish Hammer candlestick. If it can move higher and breach the nearest resistance level, the uptrend may be resumed. Otherwise, with the downtrending of the RSI, we still see further downside risks ahead. Since the index is moving in a pattern of lower lows, we maintain a negative trading bias.

We recommend that traders maintain short positons. We initiated these at 1,665.5 pts, the closing level of 14 Dec. To manage risks and protect profits, a trailing-stop can be placed above 1,624 pts.

The immediate support is marked at 1 Dec’s high – 1,606 pts, followed by 1,596.5 pts. Towards the upside, the resistance is pegged at 23 Dec’s low of 1,624 pts, followed by 1,650 pts.

Source: RHB Securities Research - 6 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024