WTI Crude - Bulls Extend the Upward Move

rhboskres

Publish date: Wed, 06 Jan 2021, 04:23 PM

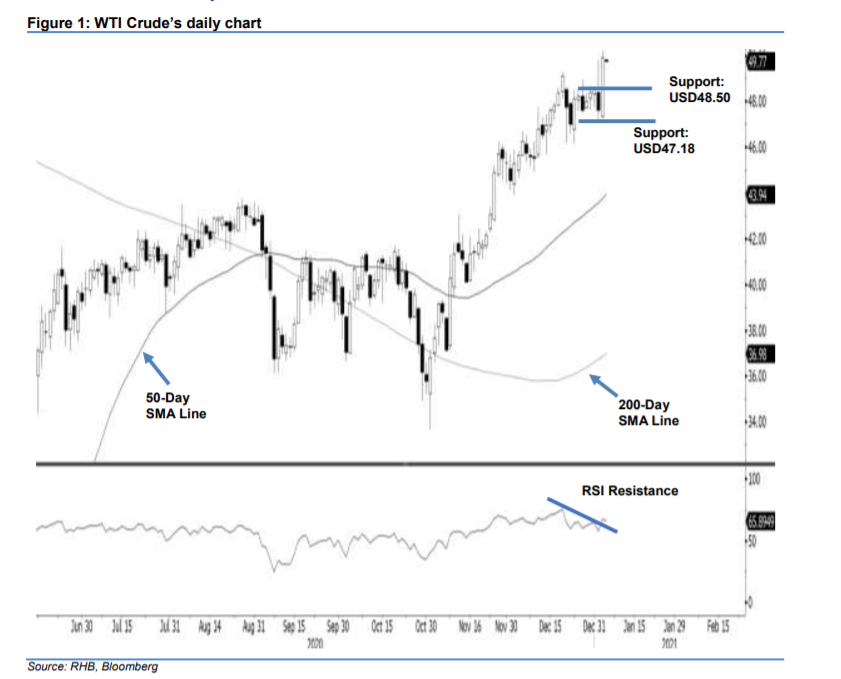

Breaking out from the correction phase; initiate long positions. In its second consecutive attempt, the WTI Crude successfully broke away from its minor correction phase. The commodity started the session off on a weak note, reaching a low of USD47.24. From this point it moved up sharply to briefly test the USD50.00 psychological level with a high of USD50.20 before closing USD2.31 higher at USD49.93 – crossing above the previous USD49.28 immediate resistance. With the breakaway from said consolidation phase, the WTI Crude has defied our expectation for it to develop a deeper correction phase. The possibility of the commodity extending its multi-month uptrend is now higher. Hence, we switch our trading bias to positive from negative.

Our previous short positions initiated at USD47.02 – ie the closing level of 22 Dec 2020 – were closed out at USD49.28 during the latest session. Concurrently, we initiate long positions. To manage risks, a stop loss can be placed below the USD47.18 mark.

Support levels are revised to USD48.50 and USD47.18 – the latter was the low of 4 Jan. Moving up, the immediate resistance is now pegged at USD50.00 and followed by USD52.00.

Source: RHB Securities Research - 6 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024