FKLI - Breaching 50-Day SMA Line

rhboskres

Publish date: Thu, 07 Jan 2021, 05:39 PM

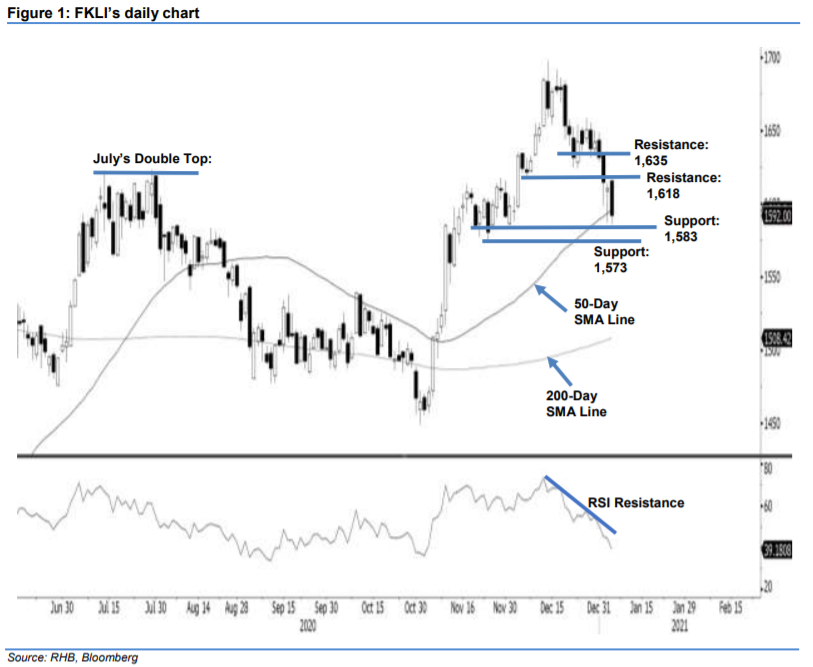

Maintain short positions. The FKLI declining for the fourth straight session yesterday, dropping by 18.5 pts to close at 1,592 pts. Following a hammer pattern formed on Tuesday, the index gapped up by 5.5 pts to open at 1,616 pts. However, the positive opening failed to spark a further rebound, and the FKLI slid to the day’s low of 1,586 pts. The latest price action saw a bearish candlestick engulfing the previous trading day’s Hammer candlestick, indicating the bears are overpowering the bulls. With RSI indicator trending lower, the 50-day SMA line will likely give way and trigger further downside risks. As the index still moving in a “lower lows” pathway, we maintain a negative trading bias.

We recommend that traders maintain short positons. We initiated these at 1,665.5 pts, the closing level of 14 Dec. To manage risks and protect profits, a trailing-stop can be placed above 1,618 pts.

The immediate support is marked at 19 Nov’s low – 1,583 pts, followed by 30 Nov’s low 1,573 pts. Towards the upside, the resistance is pegged at 27 Nov’s high of 1,618 pts, followed by 3 Dec’s high of 1,635 pts.

Source: RHB Securities Research - 7 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024