FCPO - Uptrend Taking a Pause

rhboskres

Publish date: Fri, 08 Jan 2021, 05:29 PM

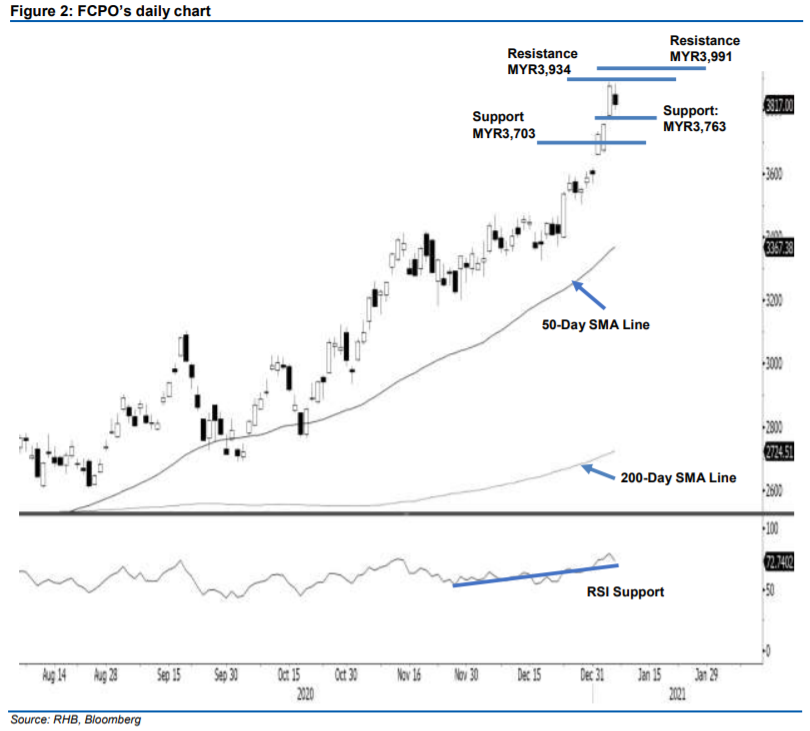

Maintain long positions. The FCPO’s rally paused yesterday, and declined MYR60.00 to close at MYR3,817. After rallying for the sixth consecutive session, the commodity gapped downwards by MYR27.00 to open at MYR3,850. The commodity tried to rebound towards the day’s high of MYR3,884, but selling pressure was great. As a result, the FCPO retraced to the day’s low of MYR3,800. Combining the price action of the last two sessions, we note the bearish reversal pattern, ie Bearish Harami. As mentioned in previous reports, we are expecting some minor corrections to happen, since the commodity is trading far from the 50-day SMA line. If the immediate support is broken, it should move into a correction phase and trend lower to test the next support of MYR3,703. As long as the trailing-stop remains intact, we will stick to a positive trading bias.

We recommend that traders maintain long positions. Our long positions were initiated at MYR3,535, or the closing level of 23 Dec. To manage risks, a trailing-stop can be set below the MYR3,763 mark.

The immediate support is marked at MYR3,763, followed by MYR3,703. Meanwhile, the immediate resistance is now pegged at MYR3,934, followed by a higher resistance of MYR3,991.

Source: RHB Securities Research - 8 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024