WTI Crude- Sustaining Its Breakout From USD50.00

rhboskres

Publish date: Fri, 08 Jan 2021, 05:37 PM

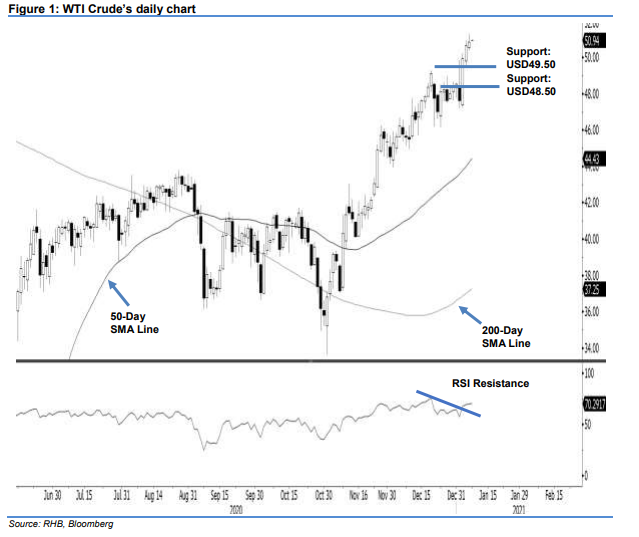

Maintain long positons. The WTI traded in a positive tone during the latest session, with prices swinging in the range of USD50.39 and USD51.28, above the USD50.00 psychological level – indicating no price rejection. At the closing, it settled USD0.20 higher at USD50.83. The commodity recently completed its near 3-week sideways trading range, and is in the process of extending its uptrend which resumed from early-Nov 2020’s low. While the RSI is marginally above the overbought threshold, in the absence of price exhaustion signals – and with the commodity continuing to trade above the USD50.00 level – we are keeping our positive trading bias.

As the trend continues to play out, we recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can be placed below the USD47.18 mark.

We are keeping the support levels at USD49.50 – near the 6 Jan’s low – and USD48.50. Moving up, the immediate resistance is set at USD52.00, and followed by USD54.00.

Source: RHB Securities Research - 8 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024