FCPO - Marching Higher To Test Upside Resistance

rhboskres

Publish date: Mon, 11 Jan 2021, 04:20 PM

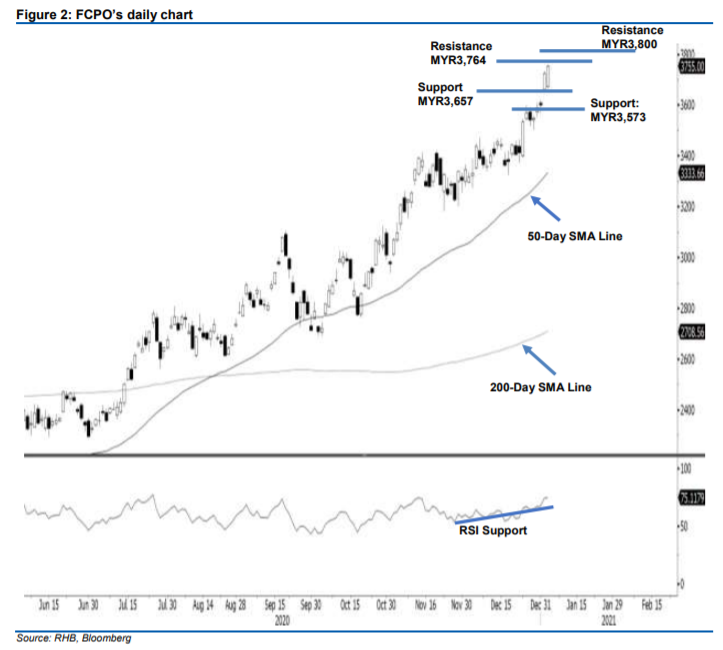

Maintain long positions. The FCPO rose higher on Tuesday, adding MYR31.00 to settle at MYR3,755. The commodity had a negative opening, gapping downwards to open at MYR3,674 and tested the day’s low of MYR3,666. The bulls repeated their buying pattern on Monday, accumulating after the noon break. As such, the commodity surged to the day’s high of MYR3,757 just before the market closed. From the price action, the bears were seen selling on a rally above MYR3,700. However, selling pressure was fully absorbed by the bulls. With the RSI moving into an overbought level of 70%, we think the commodity will continue to trend higher in the immediate term, and test the upside resistance levels marked at MYR3,764 and MYR3,800. Premised on this strong bullish interest, we maintain a positive trading bias.

We recommend that traders stick to long positions. Our long positions were initiated at MYR3,535, or the closing level of 23 Dec. To manage risks, a trailing-stop can be set below the MYR3,580 mark.

The immediate support is marked at the recent low of MYR3,657, followed by MYR3,573. Meanwhile, the immediate resistance is now pegged at MYR3,764, followed by MYR3,800.

Source: RHB Securities Research - 11 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024