WTI Crude - Moving Up the Trailling Stop

rhboskres

Publish date: Mon, 11 Jan 2021, 12:44 PM

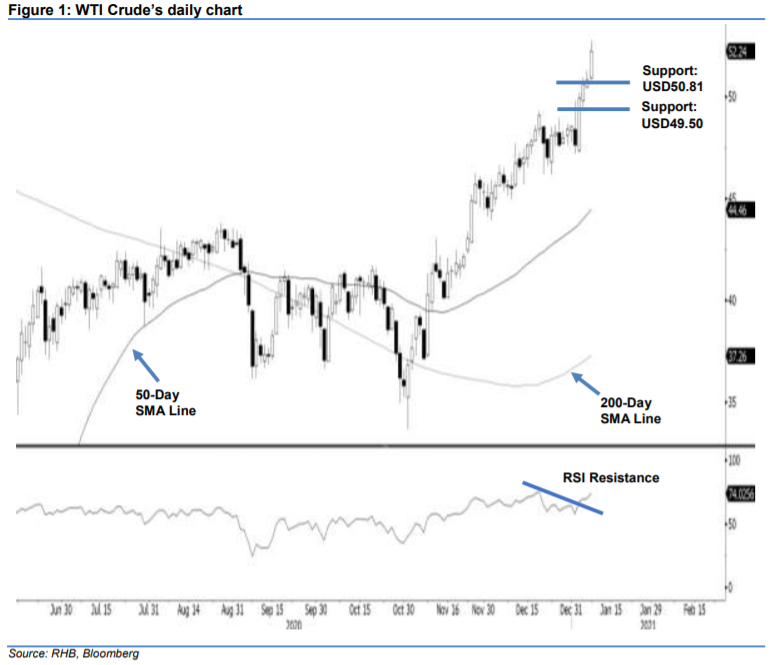

Maintain long positons. The WTI Crude generally trended up for last Friday’s entire session. From a low of USD50.81, the black gold moved higher to hit a high of USD52.75 before ending at USD52.24 – indicating a gain of USD1.41. Consequently, the previous USD52.00 immediate resistance was also crossed. The extension of the upward move came after the commodity broke through the USD50.00 psychological level last Wednesday. While the RSI reading is flashing out an overbought reading, in the absence of an adverse price signal to indicate buying exhaustion, we are keeping to our positive trading bias.

As the trend continues to play out, we recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop loss can now be placed below the USD49.50 threshold.

Support levels are revised to USD50.81 – the latest low – and USD49.50, ie near 6 Jan’s low. On the upside, the immediate resistance is now set at USD54.00 and followed by USD55.00

Source: RHB Securities Research - 11 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024