FCPO - Moving Sideways Inside The Bar

rhboskres

Publish date: Mon, 11 Jan 2021, 12:54 PM

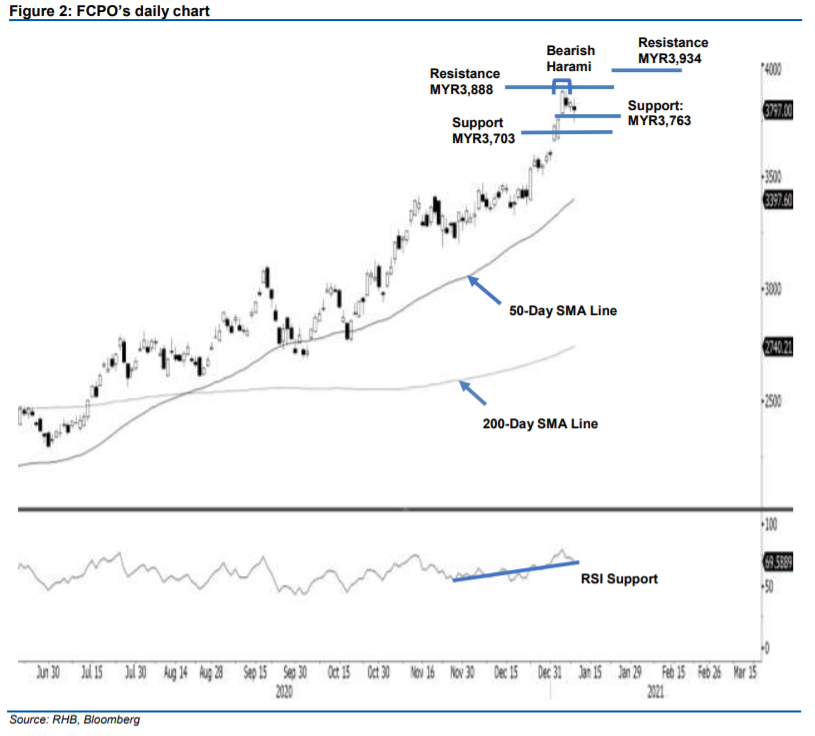

Maintain long positions. The FCPO continued to move horizontally, falling MY33.00 to settle at MYR3,797. It gapped down at the start of the session at MYR3,810. Following a shaky start, the commodity dipped to the day’s low of MYR3,740 before rebounding to a high of MYR3,846. Mild profit taking saw the commodity last trade lower at MYR3,797. As we shared previously, we expect to see it moving sideways between the resistance level of MYR3,888 and MYR3,763. The commodity attempted to breach the support level during intraday, but saw buying interest emerge and bounce back to the sideway zone. At the end of session, another inside bar or spinning top had formed. The latest price formation suggests equal strength from the bulls and bears, with both consolidating pending a breakout move. Meanwhile, the RSI is rounding at the trendline support – this shows that the momentum has eased slightly. Since the prevailing trend is bullish and the negative reversal signal has yet to happen, we stick to our positive trading bias.

We recommend that traders maintain long positions. Our long positions were initiated at MYR3,535, or the closing level of 23 Dec. To manage risks, a trailing-stop can be set below the MYR3,763 mark.

The immediate support is marked at MYR3,763, followed by MYR3,703. On the upside, the immediate resistance is eyed at 6 Jan’s high of MYR3,888, followed by a higher resistance of MYR3,934.

Source: RHB Securities Research - 11 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024