E-Mini Dow - Minor Consolidation Phase

rhboskres

Publish date: Tue, 12 Jan 2021, 12:37 PM

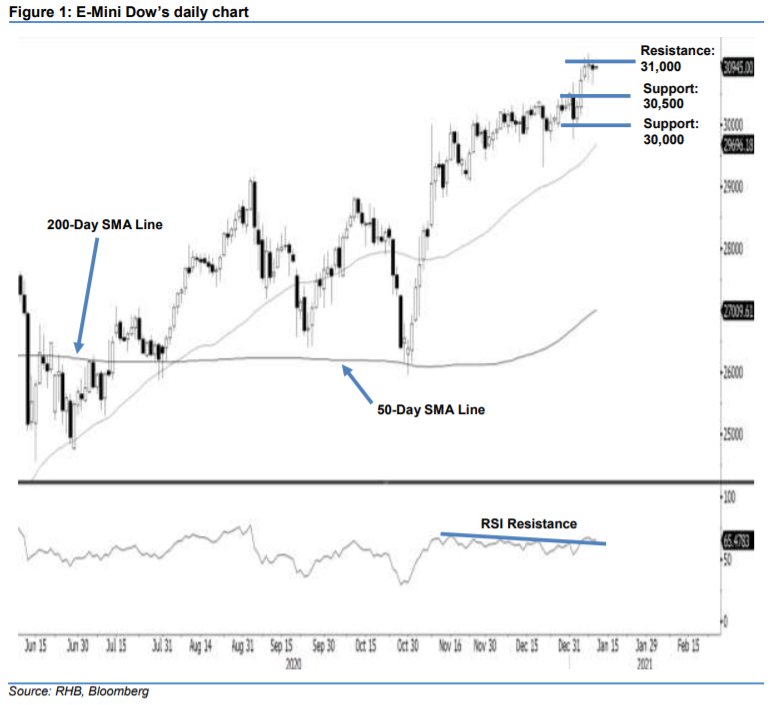

Maintain long positions while moving the trailing stop to the breakeven mark. The E-Mini Dow performed within our expectation of it developing a minor consolidation phase following recent gains. For the day, the index traded sideways in the 30,638-31,022 pts range before settling at 30,902 pts – a 91-pt drop. The minor consolidation phase that started from the previous session has, so far, been confined within the 30,600-31,150 pts range, which implies its overall positive price trend remains firmly in place. Towards the downside, should the 30,500-pt support be breached, the risk of a deeper correction may emerge. For now, we keep to our positive trading bias.

We recommend traders stay in long positions for now. We initiated these at 30,033 pts, or the closing level of 11 Dec 2020. For risk-management purposes, a stop loss can now be set at the breakeven mark.

Support levels stay at 30,500 pts and the 30,000-pt psychological level. Moving up, the immediate resistance is expected at 31,000 pts and followed by 31,500 pts.

Source: RHB Securities Research - 12 Jan 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024